AGILITY IN

A TIME OF CHANGE:

COMMON IMPERATIVEs

Since the onset of the pandemic, we have succeeded in mitigating its impact across Banyan Tree Group. With financial stability and improved business performance, we are taking advantage of this crisis to pursue value creation and opportunities in these common imperatives.

With 47 new hotels in the pipeline, we are growing our footprint in new markets while leveraging and deepening our competitive edge in the area of purposeful travel and wellbeing. This value proposition forms the foundation towards enhancing customer profitability across all our brands.

Our customer-centric, digital drive to strengthen our direct channels and touchpoints continues, to provide our guests with ease and exceptional experience in this new normal of travel. Our commitment to service excellence both online and offline continues with a stringent focus on quality in all aspects. At the same time, we are prioritising the health and safety of both associates and guests as business returns.

Meanwhile, we are increasing engagement with external partners to support positive change worldwide. These include our first eight Greater Good Grants for NGOs to execute projects benefitting nature and communities, developing new policies for tracking sustainability events and impact, and exploring renewable energy and solar power equipment for future properties.

Banyan Tree Group’s mission is to be a regenerative business that partners and benefits all stakeholders, and sustainability stewardship is embedded in all we do. With exciting new brands, sound financials, enhanced digital capabilities and a flexible, effective organisation structure, we are ready to build back better.

A ResilienT Portfolio

Key Figures

Five-Year Financial Highlights

| 2017 S$m | 2018 S$m | 2019 S$m | 2020 S$m | 2021 S$m |

|

| Revenue | 317.5 | 329.0 | 347.0 | 157.8 | 221.2 |

| Core Operating Profit1 | 38.8 | 45.5 | 65.1 | 4.3 | 5.3 |

| Operating Profit/(Loss) | 74.7 | 83.1 | 56.2 | -35.1 | 4.5 |

| Profit/(Loss) before tax (PBT) | 22.7 | 25.0 | 14.0 | -94.6 | -51.8 |

| Profit/(Loss) after tax (PAT) | 14.9 | 14.4 | 2.5 | -102.5 | -61.3 |

| Profit/(Loss) after tax & minority interests (PATMI) | 12.9 | 13.5 | 0.7 | -95.8 | -55.2 |

| Operating Profit/(Loss) Margin | 24% | 25% | 16% | -22% | 2% |

| Per share ($) | |||||

| • Basic earnings | 0.017 | 0.016 | 0.001 | -0.114 | -0.065 |

| • Diluted earnings | 0.016 | 0.015 | 0.001 | -0.114 | -0.065 |

| • Net assets | 0.924 | 0.858 | 0.890 | 0.746 | 0.627 |

| Net debt equity ratio | 0.52 | 0.47 | 0.57 | 0.72 | 0.59 |

| Net Assets | 777.5 | 719.8 | 747.4 | 627.6 | 538.1 |

Biannual Highlights

RevPAR2 (Same Store3)

Net Asset Value per Share

Net Assets

Revenue

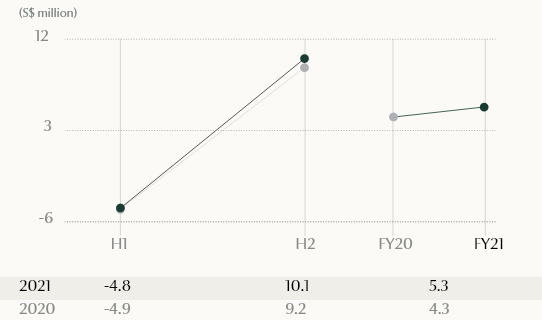

Core Operating Profit/(Loss)1

Operating Profit/(Loss)4

Operating Profit/(Loss) Margin

- Refers to Operating Profit/(Loss) excluding one-off gains or losses. This is an alternative financial measurement and does not have a standardised meaning prescribed by International Financial Reporting Standards.

- RevPAR denotes revenue per available room.

- Same Store concept excludes all new resorts opened in the past two years as they take on average two years to stabilise.

- Refers to Earnings before interests, taxes, depreciation and amortisation (“EBITDA”).

OUR BUSINESS IN BRIEF

Banyan Tree Group (“Banyan Tree Holdings Limited and its subsidiaries” or the “Group”) is one of the world’s leading independent, multi-brand hospitality groups centred on stewardship and wellbeing while offering exceptional, design-led experiences for the global travellers of today and tomorrow.

The Group’s diversified portfolio of hotels, resorts, spas, galleries, golf and residences is centred around an ecosystem of 10 global brands, including the award-winning Banyan Tree, Angsana, Cassia, Dhawa and Laguna, as well as the highly anticipated new brands of Homm, Garrya, Folio and two new Banyan Tree brand extensions, Banyan Tree Escape and Banyan Tree Veya.

Founded in 1994 on the core concept of sustainability, Banyan Tree Group seeks to create long-term value for all stakeholders and destinations across its network of properties, products and brands, through a purpose-driven mission. With approximately 8,200 associates across 23 countries, Banyan Tree Management Academy (BTMA) was established in 2008 to support the Group’s goals through advancing people development, management excellence, and learning with integrity and meaning.

Group Revenue

2021

S$ 221.2m

2020

S$ 157.8m

Revenue Figures

| 2021 S$'m | 2021 % | 2020 S$'m | 2020 % |

|

| Group | 221.2 | 100% | 157.8 | 100% |

| Hotel Investments | 59.5 | 27% | 62.2 | 39% |

| Branded Residences and Extended Stay | 122.8 | 56% | 69.4 | 44% |

| Fee-based | 38.9 | 17% | 26.2 | 17% |

| Hotel Investments | 59.5 | 100% | 62.2 | 100% |

| - Thailand | 21.9 | 37% | 44.2 | 71% |

| - Indian Ocean | 37.1 | 62% | 17.0 | 27% |

| - Others | 0.5 | 1% | 1.0 | 2% |

| Branded Residences and Extended Stay | 122.8 | 100% | 69.4 | 100% |

| - Hotel Residences | 22.3 | 18% | 58.7 | 85% |

| - Laguna Residences and Extended Stay | 8.2 | 7% | 10.7 | 15% |

| - Development Site Sales | 92.3 | 75% | - | - |

| Fee-based | 38.9 | 100% | 26.2 | 100% |

| - Hotel/Fund/Club Management | 24.9 | 64% | 10.0 | 38% |

| - Spa/Gallery Operations | 6.5 | 17% | 7.9 | 30% |

| - Design and Other Services | 7.5 | 19% | 8.3 | 32% |

Our organisation today is leaner and more responsive than it was at the onset of the COVID-19 pandemic. As events rapidly unfolded, we restructured internally to provide greater autonomy at the operating cluster levels. In addition, we developed our digital platforms and talents across the Group, not only to increase direct bookings but also to facilitate our digital transformation. The proportion of revenue contribution from direct channels of Brand.com, social and central reservations increased by 54% in 2021 as compared to pre-COVID, in 2019.

Innovative campaigns kept our brands at the forefront of travellers’ minds and boosted turnover. The Group’s Earth Day Campaign in April 2021 generated over US$1 million in revenue and financed the planting of 5,150 trees through EARTHDAY.ORG’s reforestation programme, contributing to carbon reduction in line with the United Nations Sustainable Development Goals (SDGs).

Meanwhile, Habitat, continued to be a mainstay evergreen product. Offering flexibility for extended stays that let guests work remotely with a change of scene or spend a stretch of time with family, it received a strong response in 2021.

To mark our 27th Anniversary, we invited travellers to “Rediscover the World” with exclusive upsized packages offering various experiential add-ons. This successful campaign generated a solid 486% return on investment. A regionalised execution of “The First Trip” campaign also enabled properties to be agile in their market reopening plans while capitalising on Group-level communications.

As we entered a phase of regenerative growth, the Group expanded its multi-brand ecosystem in 2021 with the launch of new brands Garrya, Homm and Folio. Like our more established brands, they are underpinned by a commitment to our proprietary “Stay for Good” framework.

Corporate branding at the Group level continued to strengthen in 2021 as a result of these initiatives. We enjoyed an increase in share of voice as compared to the previous year, whereby brand association with wellbeing and sustainability increased by about 10% and 30% respectively. While Banyan Tree Group expands its global footprint, it remains committed in its stewardship of environmental protection and community development through the Banyan Tree Global Foundation (BTGF).

As we entered a phase of regenerative growth, the Group expanded its multi-brand ecosystem in 2021 with the launch of new brands Garrya, Homm and Folio.

Hotel Investments

Revenue Contribution

Hotel Investments

S$ 59.5m

We own and manage hotels under our Banyan Tree, Angsana and Cassia brands.

We owned 11 hotels, comprising over 1,800 keys. As at 31 December 2021, revenue from our Hotel Investments came from Thailand (37%), Indian Ocean (62%) and Others (1%).

Branded Residences

and Extended Stay

Revenue Contribution

Branded Residences and Extended Stay

S$ 122.8m

This segment consists of sales of Hotel Residences, Laguna Residences and Extended Stay, and Development Site Sales.

Hotel Residences

Our Hotel Residences business comprises the sale of villas or apartments to investors under a leaseback scheme. Such residences, which are part of our hotel operations, are currently available in China, Indonesia, Mexico, Thailand and Vietnam.

Laguna Residences and Extended Stay

Laguna Residences and Extended Stay refer to sales of townhomes, bungalows and apartments that are within the vicinity of our resorts but are not part of our hotel operations. Laguna properties are currently available for sale in Thailand and Vietnam.

Development Site Sales

Development site sales relate to sales of sites that may be undeveloped, fully developed or partially developed with infrastructure.

Fee-based

Revenue Contribution

Fee-based

S$ 38.9m

Our Fee-based business comprises hotel, fund and club management, spa and gallery operations, and design and other services. We manage 44 resorts and hotels, and operate 63 spas, 64 gallery outlets and three golf courses.

Hotel, Fund and Club Management

Besides managing hotels for other owners, we manage an asset-backed destination club and a private equity fund. In addition, the Group derives royalties from the sale of properties in which we hold a minority or no interest.

Spa and Gallery Operations

We pioneered the tropical garden spa concept and manage spas within our own resorts as well as resorts owned by other operators. The Group’s retail arm, Banyan Tree Gallery, supports indigenous artistry and the livelihoods of village artisans. In 2017, we re-launched our signature range of natural, responsibly sourced Banyan Tree Essentials body and aromatherapy products, curated after an 18-month journey to ensure sustainability values are embedded throughout the product cycle.

Design and Other Services

We receive fees for design services and income from operating golf clubs. Most of our resorts are planned and designed by our experienced in-house division.