Business

Review

Hotel Investment

Banyan Group has selectively maintained assets in stronghold markets, such as Thailand, where we are well-poised to unlock value from our resorts and hotels through an end-to-end developer-operator model.

Revenue from our Hotel Investments increased by S$46.2 million from S$134.5 million in 2022 to S$180.7 million in 2023.

Hotel Investments Revenue

Revenue from our Hotel Investments increased by S$46.2 million from S$134.5 million in 2022 to S$180.7 million in 2023. The increase was mainly attributable to our hotels in Thailand, which benefited from the removal of travel restrictions that had been in place since early 2022. Occupancy for Thailand hotels was 68% as compared to 51% in 2022 and RevPAR grew 69% year-on-year. Consequently, Operating Profit increased from S$4.4 million in 2022 to S$30.7 million in 2023.

Thailand

Our hotels in Thailand posted total revenue of S$127.9 million, up 51% from 2022. This was largely due to the dramatic increase in tourism as Thailand lifted entry restrictions. The country recorded 27.25 million tourist arrivals in 2023, more than double the previous year’s 11 million. Though still short of the pre-pandemic 39 million arrivals in 2019, the substantial year-on-year improvement indicates continued recovery in the tourism sector.

Russia, China and UK were the top 3 leading markets for our Phuket hotels in 2023, with domestic travellers slipping out of the top five markets. Going forward, the intention is to achieve an optimal balance between international and local guests, to maximise profitability while cushioning the business against potential disruptions in overseas markets.

Our Laguna Phuket hotels continued to synergise, cross-promoting events and accommodation options. Laguna Holiday Club was rebranded as Homm Suites Laguna, in line with the brand expansion strategy and to cater to a different market segment.

In terms of financial performance, revenue from Banyan Tree Phuket reached an all-time high, while Angsana Laguna Phuket, Cassia Phuket and Homm Suites Laguna delivered 67% more revenue than in the previous year.

Occupancy at Banyan Tree Bangkok rebounded to 77%, closely matching the 78% occupancy posted in 2019. International guests accounted for 95% of rooms sold in 2023, with China occupying the top spot 22%. The iconic F&B outlets at Banyan Tree Bangkok contributed 51% of its revenue and remain a strong draw for the domestic market.

Management is attuned to the intense competition in Bangkok and Phuket, as a stream of new keys enters the market. Property improvements play an important role in enabling our hotels to stand out, with Angsana Laguna Phuket among those undergoing planned enhancements in 2024. At the same time, we continue to place great emphasis on innovative offerings and staff training to make every guest experience one that befits our brands.

Maldives

Our three Maldives resorts recorded revenue of S$43.5 million in 2023, S$1.7 million lower than the previous year. The decrease was mainly due to increased competition from other destinations as more countries reopened to tourism in 2023. China, Great Britain and Russia were the top source markets for Banyan Tree Vabbinfaru, Dhawa Ihuru (formerly Angsana Ihuru) and Angsana Velavaru respectively.

To elevate F&B offerings at Banyan Tree Vabbinfaru, we launched Madi Hiyaa, an exceptional overwater yakitori restaurant and bar. Seamlessly blending authentic Japanese culinary delights with a Maldivian touch, the restaurant started operations in November 2023.

Indonesia

Revenue from our hotels in Indonesia grew by 125% year-on-year to S$7.5 million, further reflecting the easing of travel restrictions for both domestic and international arrivals. The increasing frequency of ferries from Singapore also helped to drive business for Cassia Bintan, which contributed 70% of revenue for the year.

Morocco

Angsana Riads Collection saw revenue increase by 51% or S$0.7 million. Guests from UK and France accounted for 44% rooms sold, followed by Germany and Italy with a combined 22%. The earthquake in September impacted two Riads, with 16 rooms temporarily excluded from the inventory while undergoing renovations.

Residences

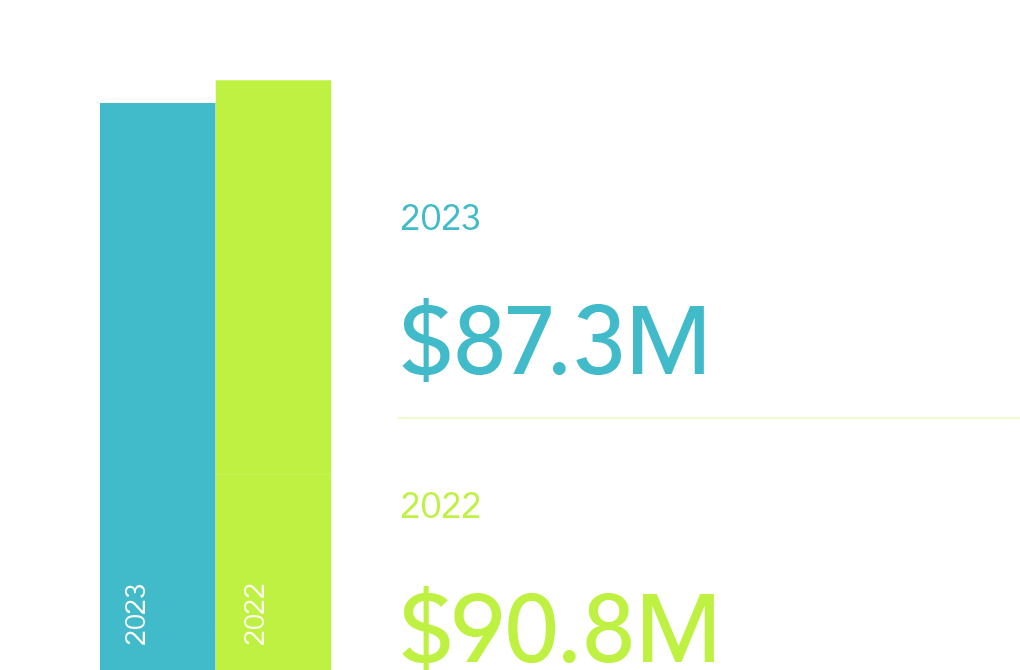

Our Residences segment is integral to the Group’s “asset-right” approach, as the development of residences, in conjunction with existing resort developments, generates positive cash flow to lower the investment outlay. Total revenue for 2023 was S$87.3 million, 4% lower than the previous year’s S$90.8 million. The decrease was attributable to the lower handover and recognition of Skypark condominiums in 2023 versus in 2022.

Residences Revenue

In tandem with the post-pandemic rebound in tourism, sales saw strong momentum despite global geopolitical and economic uncertainty. In 2023, we achieved total sales value of S$267.8 million, a 23% rise from 2022, setting a new record for presales. Due to ongoing capital flight from Russia due to the war in Ukraine and the increase in direct flights from Russia to Phuket, Russia remained our largest source of buyers in 2023. Phuket’s luxury low-rise residential market witnessed robust demand from high-net-worth individuals, following Thailand’s introduction of the long-term resident visa and the new Thailand Elite visa programme. Other factors driving demand included a shift from financial assets to hard assets, such as real estate, in response to rising inflation.

Our strategy remains to unlock value from our land bank by actively rolling out new projects to market to meet ongoing demand. During the year, we launched several new projects including Banyan Tree Grand Residences Beach Terraces, Laguna Lakeside, Banyan Tree Residences Beach Residences and Banyan Tree Residences Beach Villas. We also unveiled Laguna Lakelands in Phuket, an ambitious nature-infused project showcasing a diverse landscape, including a rainforest park, orchard, lakeside, lagoon, valley and forest. The first projects at Laguna Lakelands – Laguna Lakelands Lakeview Residences and Waterfront Villas – achieved strong sales traction after their launch in December 2023.

Thailand’s luxury branded residence market is flourishing, attracting affluent buyers and experiencing significant growth, with a focus on global ultra-high-net-worth individuals.

We continue to see a shift in demand to mid-scale, upscale and luxury segments for well-positioned branded residences. The pandemic caused people to rethink their lifestyle and work preferences, such as living in less densely populated locations and the ability to work from home. Upscale and luxury property buyers are also less prone to the impact of economic uncertainty. Our products, which range from affordably priced apartments to high-end branded residential offerings, are well-positioned to cater to these market segments.

Overall, 432 units were sold in 2023 at a total sales value of S$267.8 million (2022: 354 units totalling S$217.2 million), mostly consisting of units at Banyan Tree Grand Residences Grand Villas, Banyan Tree Grand Residences Seaview Residences, Banyan Tree Grand Residences Beach Terraces, Banyan Tree Residences Beach Residences, Banyan Tree Residences Beach Villas, Angsana Oceanview Residences, Cassia Phuket, Skypark, Laguna Lakeside, Laguna Beachside, Laguna Seaside, Laguna Lakelands Lakeview Residences, Laguna Lakelands Waterfront Villas and Laguna Park Phuket, all of which are located in Phuket.

Revenue recognised in 2023 was mainly from Angsana Oceanview Residences, Banyan Tree Grand Residences Grand Villas, Cassia Phuket, Skypark, Laguna Village Residences and Laguna Park Phuket. In the previous year, revenue recognised was largely from Angsana Beachfront Residences, Banyan Tree Grand Residences Grand Villas, Banyan Tree Pool Villas, Cassia Phuket, Skypark, Laguna Village Residences and Laguna Park Phuket.

We have a healthy pipeline of sales revenue amounting to S$377.7 million, to be recognised upon completion in 2024 and beyond. This consists mainly of units at Angsana Oceanview Residences, Banyan Tree Grand Residences Grand Villas, Banyan Tree Grand Residences Oceanfront Villas, Banyan Tree Grand Residences Seaview Residences, Banyan Tree Grand Residences Beach Terraces, Banyan Tree Residences Beach Residences and Banyan Tree Residences Beach Villas, Skypark, Laguna Lakeside, Laguna Beachside, Laguna Seaside, Laguna Lakelands Lakeview Residences, Laguna Lakelands Waterfront Villas and Laguna Park Phuket.

Strong demand for real estate is forecast for 2024. Thailand’s luxury branded residence market is flourishing, attracting affluent buyers and experiencing significant growth, with a focus on global ultra-high-net-worth individuals. China, one of our key source markets, and Thailand have agreed to a permanent visa-free policy starting March 2024, fostering diplomatic relations and stimulating economic activity in their respective tourism sectors. Accordingly, we expect to benefit from rising tourism arrivals, our extensive sales network and stellar brand reputation. To capitalise on this, we intend to focus on further sales channel development, and online and digital marketing activities.

| 2023 | 2022 | |||

| Units Sold | Total (in S$ million) | Units Sold | Total (in S$ million) |

|

| Angsana Beachfront Residences | - | - | 5 | 9.2 |

| Angsana Oceanview Residences | 26 | 44.8 | 13 | 14.9 |

| Banyan Tree Grand Residences Grand Villas | 4 | 14.7 | 2 | 6.2 |

| Banyan Tree Grand Residences Oceanfront Villas | - | - | 3 | 15.6 |

| Banyan Tree Grand Residences Seaview Residences | 4 | 12.3 | 7 | 28.1 |

| Banyan Tree Grand Residences Beach Terraces | 6 | 22.6 | - | - |

| Banyan Tree Pool Villas | - | - | 2 | 3.6 |

| Banyan Tree Residences Beach Residences | 2 | 7.8 | - | - |

| Banyan Tree Residences Beach Villas | 3 | 27.7 | - | - |

| Cassia Phuket | 3 | 0.9 | 11 | 2.7 |

| Laguna Park Phuket | 14 | 12.0 | 4 | 3.2 |

| Laguna Village Residences | - | - | 5 | 8.6 |

| Skypark | 226 | 62.3 | 118 | 29.0 |

| Laguna Beachside | 8 | 6.1 | 174 | 89.6 |

| Laguna Seaside | 27 | 16.9 | 9 | 6.1 |

| Laguna Lakeside | 89 | 27.5 | 1 | 0.4 |

| Laguna Lakelands Lakeview Residences | 18 | 7.1 | - | - |

| Laguna Lakelands Waterfront Villas | 2 | 5.1 | - | - |

| 432 | 267.8 | 354 | 217.2 | |

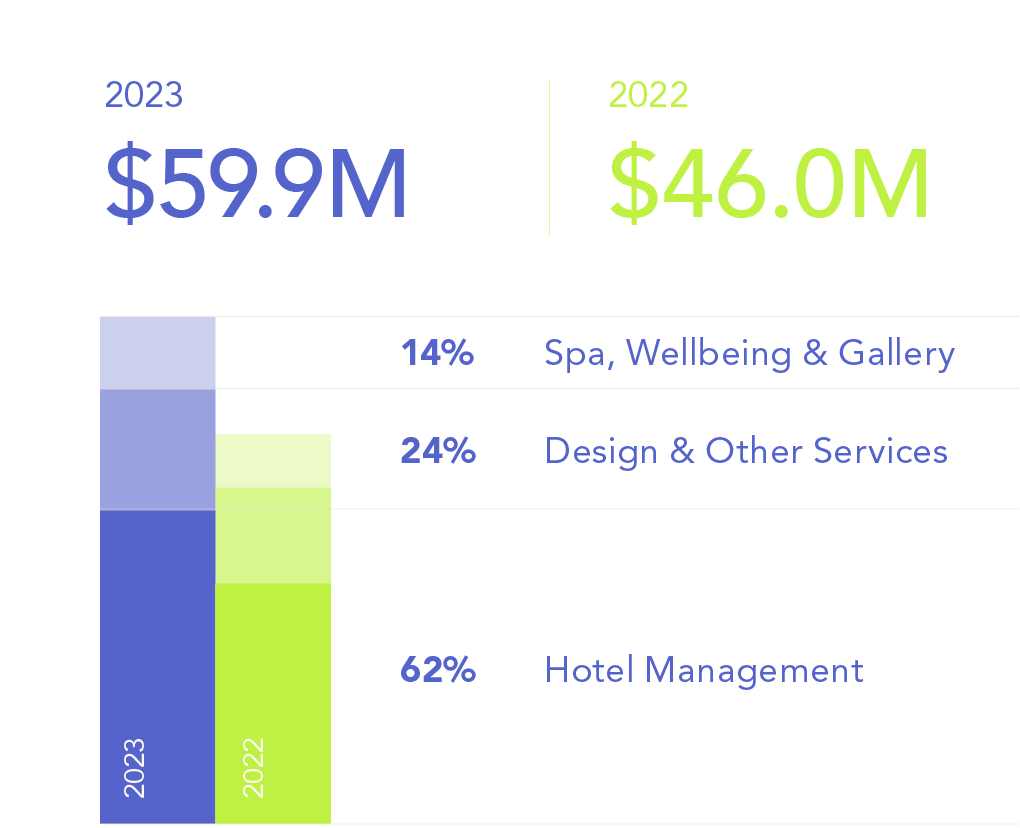

Fee-Based

Hotel Management

Total revenue from hotel management contracts was S$37.0 million in 2023, up 31% or S$8.7 million compared to the previous year. This was due mainly to a substantial increase in management fees from Group-managed resorts in the Asia Pacific. Operating Profit decreased by S$3.0 million from S$10.7 million to S$7.7 million in 2023, largely because of higher operating expenses.

China

Following the relaxation of pandemic measures in December 2022, our China hotels saw a convincing turnaround in 2023, with a 55% operating revenue increase from the previous year. Operating revenue on a same-store basis was also 12% higher than it was in 2019 before the pandemic.

Asia Pacific (excluding China)

Hotels managed by the Group in the Asia Pacific region saw overall room revenue increase by 64% year-on-year.

Both Banyan Tree Kuala Lumpur and Pavilion Hotel Kuala Lumpur recorded their highest revenue since opening, surpassing their previous highs in 2022, reflecting strong demand from local and international business sources. Similarly, Banyan Tree Club & Spa Seoul posted record-breaking revenue for a second year in a row, with a robust contribution from the domestic market and effective brand positioning.

We launched two new properties in Vietnam: Angsana Ho Tram and Dhawa Ho Tram, the Group’s first Dhawa property in the country. In Indonesia, Homm Saranam Baturiti began operations in Bali and Garrya Bianti Yogyakarta in central Java.

The Group’s footprint in Japan grew with the opening of Homm Stay Yumiha Okinawa and Folio Sakura Shinsaibashi Osaka. In Thailand, Homm Chura Samui, which is a conversion project, started operations in December, adding 65 keys to our two established properties in Koh Samui.

Europe, Middle East and Africa

Banyan Tree Tamouda Bay saw a 14% increase in operating revenue to S$10.6 million. Local guests continue to be the main source of business, with another 17% of stays coming from France, Belgium, Germany and the US.

Angsana Corfu, Greece, generated operating revenue of S$19.5 million, down 2% from the previous year.

Our third resort in strategic collaboration with Accor-Ennismore Hotels in the Middle East began operations in 2023. Banyan Tree Dubai Phase I launched in November, with Phase II expected to be completed by May 2024.

Americas

Room revenue at Banyan Tree Mayakoba increased by 6% or S$3.2 million year-on-year. However, Banyan Tree Cabo Marqués registered a decrease of 23% or S$1.5 million, due to its temporary closure following Hurricane Otis. The storm in October 2023 caused widespread damage to the resort destination of Acapulco. We are taking the opportunity to rejuvenate Banyan Tree Cabo Marqués and expect to re-open it in November 2024.

Banyan Tree Puebla saw a 19% rise in room revenue to S$3.2 million attracting a primarily domestic clientele, with 71% of room sales coming from Mexico and 19% from the US.

Fee-Based Revenue

In the Pipeline

2024 will see the Group’s continued multi-brand, multi-market expansion.

Banyan Tree Higashiyama Kyoto 52 keys will be our first Banyan Tree resort in Japan. Further elevating our brand presence and market positioning will be the conversion projects for three Homm-branded properties (58 keys in total) in Kyoto. These openings will bring to eight the number of properties in Japan operating under the Group’s various brands.

We will also launch the first Cassia property in South Korea. With close to 700 keys, Cassia Sokcho will be the Group’s largest single property by number of keys. Our presence in South Korea will expand further with the opening of Homm Sokcho (150 keys).

Vietnam continues to be an exciting destination for us, with the anticipated opening of Angsana Quan Lan (156 keys) near the world-famous Ha Long Bay. Our first Garrya in Vietnam, Garrya Mu Cang Chai 109 keys, will also be situated amid breathtaking natural scenery, in the country’s northwestern highlands.

The opening of Angsana Siem Reap (158 keys) will mark our entry into Cambodia. Its proximity to Siem Reap International Airport and Angkor Wat is expected to draw leisure travellers.

In the Americas, Banyan Tree Veya, Valle de Guadalupe will be our fifth property in Mexico. Located near the city of Ensenada and one hour south of the US border, the 30-villa resort sits on land with vineyards, a winemaking room and a hilltop restaurant.

The Group’s expansion in China continues with the following openings in 2024: Banyan Tree Dongguan Songshan Lake (166 keys), Banyan Tree Suzhou Shishan (60 keys), Angsana Suzhou Shishan (153 keys), Banyan Tree Yangcheng Lake (70 keys), Garrya Yangcheng Lake (212 keys), Garrya Xianju (195 keys), Homm Zhuhai Hengqin (137 keys), Homm Changchun Beihu (255 keys), Dhawa Stay Dalian Golden Pebble Beach (110 keys) and Angsana Tengchong (174 keys). These 10 new hotels will usher in a new chapter of growth in China for Banyan Group.

Spa, Wellbeing and Gallery

The Group’s iconic Spa, Wellbeing and Gallery operations registered total revenue of $8.6 million in 2023. Operating Profit increased by S$2.4 million, turning from a loss of S$0.3 million to a profit of S$2.1 million. Contributing to this were improving market conditions and successful Group-level promotions. With the Group’s hotels anticipating increasing occupancies and a higher capture rate, we expect continued revenue growth in 2024.

spa and wellness awards won since inception

Banyan Tree Wellbeing Sanctuaries

Spa and Wellbeing Operations

The Spa & Wellbeing business is experiencing both rapid growth and an increasingly competitive landscape. We are responding by introducing innovative experiences that seamlessly integrate elements of holistic wellbeing, including Sense of Place therapies, Retreats and room products.

In 2023, we rolled out another two Banyan Tree Wellbeing Sanctuaries, at Banyan Tree Bangkok and Banyan Tree Vabbinfaru, Maldives. This brings the total number of Wellbeing Sanctuaries to 19. The Wellbeing Passport will be implemented at all participating properties by 2024, alongside enhanced in-room and on-request wellbeing amenities and a targeted focus on Rest as a Wellbeing Pillar.

Awards

We have won 732 spa and wellness awards since inception, including 21 awards in 2023.

Four of our Banyan Tree Spa outlets (Bangkok, Phuket, Krabi and Samui) won the Thailand Tourism Gold awards in the Tourism Health – Spa category. The prestigious awards recognise tourism products and services that are of high quality as well as socially and environmentally responsible.

Banyan Tree Spa Macau secured multiple accolades, including Spa China’s Grand Jury Award for Wellness and Spa and the World Spa Award for Macau’s Best Resort Spa. These high-profile awards are treasured affirmation from spa experts, operators and enthusiasts around the world.

In addition, Banyan Group was named Most Active Hotel Group for World Wellness Weekend in September, with 35 of our hotels and resorts taking part in the celebrations.

Spa & Wellbeing Academy

Our spa therapists around the world undergo training with the Banyan Spa & Wellbeing Academy. After a two-year hiatus during the pandemic, the Academy relaunched in July 2023. For the first time in its 22-year history, the Academy, which is accredited by Thailand’s Ministries of Education and Health, opened enrolment to the public. This will help develop professionalism in the spa industry as a whole.

Gallery Operations

The Gallery saw robust recovery in 2023. Diversified revenue streams – retail outlets, shipments to Group hotels and spas, e-commerce, corporate sales, and wholesale –generated total revenue of S$6.4 million, up 82% from the previous year. The EBITDA margin of 27% also outperformed 2022 by 126%.

Shipment sales, buoyed by the resurgence of tourism and the launch of Banyan Tree Dubai, contributed 70% of total revenue. The revamped e-commerce platform and partnerships with influential key opinion leaders, including participation in Tmall live streams, catalysed a significant uptick in online sales. This digital pivot expanded the Gallery’s reach and enhanced brand resonance in the virtual marketplace.

Corporate gifting was another revenue pillar, with major banks in Thailand facilitating outreach to a 40,000-strong database. The Gallery’s commitment to sustainability and the “Gift for Good” philosophy was evident in the use of 5,000 kg of cassava agricultural waste to produce 31,000 eco-friendly gifts.

Despite challenges in the duty-free market in Korea, Gallery’s wholesale and travel retail segments remained resilient.

PORTFOLIO AND NEW OPENINGS

In 2023, we opened six new Spas in China, Dubai, Indonesia, Thailand and Vietnam. We plan to open 13 more outlets in 2024 in China, Cambodia, Japan, Mexico, South Korea and Vietnam. This will expand the Banyan Group’s global portfolio of spas to 75 outlets.

The February 2024 opening of Banyan Tree Veya,

Valle de Guadalupe, Mexico, is notable as the Group’s first destination wellbeing retreat resort. Comprising 30 keys, it offers unique treatments embracing vinotherapie and Temazcal experiences.

We added seven new Gallery outlets in China, Indonesia, Maldives, Mexico and Vietnam during the year. Following the closure of seven outlets due to conversion and cessation of management agreements, the Gallery now boasts 59 outlets in 16 countries.

new spas in 2024

new galleries in 2024