Corporate Governance Report

Banyan Tree Holdings Limited (“BTH” or the “Company”, and together with its subsidiaries, the “Group”) is committed to ensuring a high standard of corporate governance and to promote accountability, transparency and shareholders’ value which are essential to investor confidence and the long-term sustainability of the Group’s business and performance.

This report describes the Group’s corporate governance structures and practices that are in place throughout the financial year ended 31 December 2023 (“FY2023”), with specific reference made to the principles and provisions of the revised Code of Corporate Governance 2018 (the “Code”), which forms parts of the continuing obligations of the Listing Rules of the Singapore Exchange Securities Trading Limited (“SGX-ST”). The preparation of this report was also guided by the voluntary Practice Guidance which was issued to complement the Code and which sets out best practices for companies.

(A) Board Matters

Principle 1: Board’s Conduct of its Affairs

1. The Company is headed by an effective Board that works with the Senior Management to achieve the Group’s strategic objectives and long-term success, and ensuring that the necessary resources are in place to meet these objectives.

The Board’s principal functions include:

- providing leadership, formulation of the Group’s overall long-term strategic direction as well as operational initiatives;

- setting its values and ethics, standards of conduct and organisational culture, and ensures proper accountability within the Group;

- reviewing financial performance and risk matters including annual budgets, financial plans, major investments, divestments and fund-raising exercises;

- overseeing the business affairs of the Company and holding Management accountable for performance;

- reviewing the adequacy and effectiveness of internal controls including financial, operational, compliance and information technology controls, and the risk management framework of the Group to effectively monitor and manage risks;

- approving remuneration policies and guidelines as well as succession planning for the Board and Management, including the appointment and re-appointment of Directors;

- ensuring the Group’s compliance with all laws and regulations as may be relevant to its businesses as well as proper accountability within the Company;

- considering sustainable development as a core strategic approach of the Group; and

- acting as the governing body by approving the material Environmental, Social and Governance (“ESG”) factors and providing oversight and input on the progress of performance against set targets.

Please refer to the Sustainability Report 2023 (to be issued by the end of April 2024) for the continual progress made in the Group’s commitment to sustainability and addressing environmental, sustainability and governance concerns in its business operations.

2. In accordance with the Group’s Code of Corporate Conduct and Ethics Policy (including Conflicts of Interest) that was put in place by the Board, each director is required to promptly disclose any conflict or potential conflict of interest, whether direct or indirect, in relation to a transaction involving the Group as soon as is practicable after the relevant facts have come to his/her knowledge. Where a director has a conflict or potential conflict of interest in relation to any matter, he/she shall immediately declare his/her interest in the matter, and recuse himself/herself from discussions and decisions involving the issues of conflict. The Board may also require that the conflicted director provide information or inputs where necessary.

3. The Group has adopted a set of internal controls and guidelines setting out the financial authorisation and approval limits for borrowings, acquisitions and disposals of investments, and operating and capital expenditures. The Board’s approval is required for transactions where the value of these transactions exceeds the approval limits. In addition, matters such as, inter alia, the issue of shares, dividend distributions and other returns to shareholders, the Group’s strategies and objectives, and the announcement of periodic and full-year results also require the Board’s approval. The Board decides on matters that require its approval and communicates this clearly to Management in writing.

4. There are three Board Committees, namely the Audit and Risk Committee (“ARC”), the Remuneration Committee (“RC”) and Nominating Committee (“NC”). All these Board Committees are constituted with defined written Charters to assist the Board in the execution of its responsibilities. These Charters set out the compositions, authorities and duties of the Board Committees (including reporting-back to the Board), and are reviewed on a periodic basis to ensure their continued relevance. Save for Mr Ho KwonPing, the Executive Chairman of the Board who is serving as an NC member since 20 May 2021, members of the ARC, the NC and the RC comprise only Independent Directors.

5. The Board and the Board Committees conduct regular scheduled meetings, at which Directors actively participate in discussing and deliberating on matters requiring their attention and decision. Directors facing conflicts of interest recuse themselves from discussions and decisions involving the issues of conflict. All Board and Board Committee meetings are scheduled in advance of each calendar year in consultation with the Directors and are notified to all Board Members before the start of that calendar year. When a physical meeting is not possible, timely communication with the members of the Board is achieved through telephonic attendance and video conferencing or other similar means of communication, as permitted under the Constitution of the Company (the “Constitution”). Ad-hoc meetings are convened when circumstances require. The non-executive directors and independent directors meets every quarter without the presence of Management to discuss matters without the influence of Management. Additionally, Independent Directors also allocate dedicated time to meet at least twice a year, without the presence of Management and Non-Independent Directors, to review performance of Management in meeting the goals and objectives of the Company. The Lead Independent Director will provide any relevant feedback to the Executive Chairman after such meetings. Directors with multiple board representations ensure that sufficient time and attention are given to the affairs of the Company. Details of each Director’s attendance at Board and Board Committee meetings as well as the Annual General Meeting of the Company (“AGM”) held during FY2023 are provided in Table 1 below:

Table 1

| Board Members | Board | ARC | RC | NC | AGM |

| No. of Meetings Held | 5 | 4 | 2 | 3 | 1 |

| Ho KwonPing (Executive Chairman) | 5/5 | - | - | 3/3 | 1/1 |

| Tan Chian Khong (Lead Independent Director) | 5/5 | 4/4 | - | 3/3 | 1/1 |

| Karen Tay Koh (Independent Director) | 4/5 | 4/4 | 2/2 | - | 1/1 |

| Paul Beh Jit Han (Independent Director) | 5/5 | - | 2/2 | 3/3 | 1/1 |

| Arnoud Cyriel Leo De Meyer (Independent Director) | 5/5 | - | 2/2 | 3/3 | 1/1 |

| Lien Choong Luen (Independent Director) | 5/5 | 4/4 | - | - | 1/1 |

| Parnsiree Amatayakul (Independent Director) | 5/5 | - | - | - | 1/1 |

| Gaurav Bhushan (Non-Independent Non-Executive Director) | 3/5 | - | - | - | 1/1 |

| Ho Ren Hua (Non-Independent Non-Executive Director) | 4/5 | - | - | - | 1/1 |

| Ding ChangFeng (Non-Independent Non-Executive Director) | 2/5 | - | - | - | 0/1 |

| Abdulla Ali M A Al-Kuwari (Non-Independent Non-Executive Director) | 4/5 1 | - | - | - | 1/1 |

| Abdul Rahim bin Mohamed Ali (Alternate Director to Abdulla Ali M A Al-Kuwari) | 1/5 2 | - | - | - | - |

- There was one board meeting attended by Mr Abdulla Ali M A Al-Kuwari’s alternate director, Mr Abdul Rahim bin Mohamed Ali.

- Mr Abdul Rahim bin Mohamed Ali has attended one board meeting as alternate director to Mr Abdulla Ali M A Al-Kuwari.

6. Upon appointment, each new Director is issued with a formal letter of appointment along with materials pertaining to his obligations in relation to disclosure of interests in securities, conflicts of interest and restrictions on dealings in securities. An orientation programme is conducted for new Directors to familiarise themselves with the Group’s businesses, operations, strategic directions, and the Group’s structure and core values and to be acquainted with Management, thereby facilitating Board interaction and independent access to Management. Each new Director will also receive information on the relevant policies and procedures of the Group and the Board meeting schedule for the year, as well as a brief of the routine agenda for each Board and Board Committee meeting. When a Director is appointed to a Board Committee, a copy of the Charter of the Board Committee is provided. The NC ensures that each new Director is aware of his/her directorship duties, responsibilities and obligations as a member of the Board.

7. A Director who has no prior experience as a director of an SGX-listed company is required to undergo training in the roles and responsibilities of a director of a listed issuer as prescribed by the SGX-ST. All our Directors have completed the requisite training by Singapore Institute of Directors (“SID”) in FY2023.

8. On 17 March 2022, SGX Regco announced the requirement for all directors of listed companies to attend sustainability training to equip themselves with basic knowledge on sustainability matters. All our Directors have also completed the sustainability training as prescribed by the SGX-ST.

9. The Board believes that knowledge, regular training, and professional development are essential to enhancing the Board’s effectiveness. The Company adopts a proactive approach in directors’ training and has an on-going budget for all directors to attend appropriate courses, conferences and seminars. Directors are provided with continuing education and professional development opportunities in areas such as directors’ duties and responsibilities, corporate governance, changes in financial reporting standards, and industry-related matters. This keeps them updated on matters that may impact their performance as Board or Board committee members. Relevant trainings (as approved by the NC) will be at the Company’s expense. In respect of FY2023, a number of directors have participated in the selected initiatives/sessions as part of their individual training. These sessions include:

| Areas of Topics | Conducted by |

| Singapore Governance and Transparency Forum 2023 | SID |

| Beyond the 9-year Rule – How Nominating Committees can Transform Governance | SID |

| Director Financial Reporting Fundamentals | SID and ISCA |

| Leading for Impact (LIP) | Institute of Corporate Directors Malaysia |

10. The Company also provides the Board with updates on developments and changes in laws, regulations, or changes in regulatory requirements and financial reporting standards, which are relevant to or may affect the Group’s businesses. Directors have been periodically updated on various aspects of the Group’s operations through briefings, informal discussions and meetings with Management. In FY2023, our Directors have attended briefing sessions conducted by both internal and external consultants on the Group’s business, operations and strategic affairs. These include a Risk Management session (Task Force on Climate-Related Disclosure) for our ARC directors conducted by South Pole, as well as a sustainability briefing session on climate change for the Board conducted by a team of sustainability specialists from Ernst & Young in November 2023. Other than Southpole, the Group’s panel of consultants also include Willis Towers Watson (WTW) and Carbon Resources International (CRX).

11. All Directors are encouraged to visit the Group’s properties for a personal experience and to provide feedback or suggestions for improvement. Individual directors visited various properties on their own over the year and interacted with the managers to familiarize with our businesses. As part of training and development, the Company organised a Board Strategy Retreat to China in October 2023. During the retreat, the Board reviewed forward-looking strategies for the Group and inspected the Group’s development properties (Banyan Tree Shanghai, Banyan Tree Nanjing, Garrya Huzhou, Homm Huzhou, Banyan Tree Anji, Banyan Tree Hangzhou, Angsana Zhuhai, Angsana Hengqin and Garrya Hengqin.). The retreat greatly enhanced each Director’s knowledge on the Group’s hotel operations.

12. The Directors are provided with Board Papers by Management via electronic means (in the form of emails and via a secured Board Portal) in advance of each Board and Board Committee meeting to enable them to be properly informed of matters to be discussed and/or approved, and to enable each Director to make informed decisions and discharge their responsibilities and duties. These include reports relating to the financial and operational performance of the Group as well as other matters for the decision or information of the Board. Every quarter, Management will introduce different strategic themes and invite the relevant Business Unit leads or external professionals to brief the board. Upon request, directors will be provided with additional information and reports to enable them to have a better understanding of the Group’s business and strategies, the operating environment and the risks faced by the Group.

13. Management provides the Board with management accounts and explanations and information on an on-going basis and as the Board may require from time to time, enabling the Board to make a balanced assessment of and informed decisions on the Company’s and the Group’s performance, position and prospects, and to discharge its duties and responsibilities. Such information consists of consolidated profit and loss accounts, operating profit, and pre-tax profit by the various business segments comparing BTH’s actual performance against the budgets, together with explanations for significant variances. The Directors may also, at any time, request further information or meetings with Management on the Group’s operations.

14. The Board reviews and approves the Company’s financial results as well as the relevant announcement before releasing the same on SGXNET. The Board also reviews legal and regulatory compliance reports from Management to ensure that the Group complies with the relevant regulatory requirements. The Board, through its results announcements, aims to provide shareholders with a balanced and clear assessment of the Group’s performance and prospects on a periodic basis. The Board also ensures timely and full disclosure of material corporate developments to shareholders.

15. Each Director has separate and independent access to Management and the Company Secretary at all times. The Company Secretary assists the Chairman and the Chairman of each Board Committee in developing the agendas for the various Board and Board Committees meetings, attends all Board and Board Committee meetings, ensuring that Board procedures are observed and that applicable rules and regulations are complied with, and prepares minutes of meetings. Under the direction of the Chairman, the Company Secretary ensures timely and good information flows within the Board and its Board Committees and between Management and independent directors. The Company Secretary is responsible for, among other things, advising the Board on corporate and administrative matters as well as all matters relating to corporate governance. The appointment and the removal of the Company Secretary is a matter for the Board as a whole.

16. All Directors (including the Independent Directors) whether individually or collectively have separate and independent access to independent experts and professional advice as and when necessary to enable them to discharge their responsibilities effectively and such costs are borne by the Company.

17. BTH was placed on the SGX Fast Track programme since the inception of the programme in 2018. SGX Fast Track was introduced on 4 April 2018 in recognition of the efforts and achievements of listed issuers which have upheld high standards of corporate governance and maintained a good compliance track record.

Principle 2: Board Composition and Guidance

1. Provision 2.2 of the Code provides that independent directors should make up a majority of the Board where the Chairman is not independent. As at the date of this report, the Board comprises 11 Directors (excluding one alternate director), and more than half of the Board is made up of Independent Directors. All Directors are non-executive directors, save for Mr Ho KwonPing who is the Executive Chairman of the Board. As such, there is a strong and independent element on the Board, capable of exercising independent and objective judgement on corporate affairs of the Group. It also ensures that key issues and strategies are critically reviewed, constructively challenged, fully discussed and thoroughly examined, taking into consideration of the long-term interests of the Group and its stakeholders, in line with the intent of Principle 2 of the Code. Please see the list of Independent and Non-Independent Directors in the Annual Report for FY2023 (“Annual Report”).

2. Each year, the NC reviews the appropriate size, level of independence and diversity of thought and background in the composition of the Board and Board Committees ensuring that each member has the expertise, skills and attributes to discharge his/her responsibilities effectively. The NC also ensures that there is an appropriate number of Independent Directors for the Board and each Board Committee. Based on the declarations of independence submitted by Directors annually and reviewed by the NC, none of the Independent Directors has any relationship with the Company, its related corporations, its substantial shareholders or officers of the Company that could interfere, or be reasonably perceived to interfere, with the exercise of their independent business judgement in the best interests of the Company. In particular, none of the Independent Directors is or has been employed by the Company or any of its related corporations in the current or any of the past three financial years or has an immediate family member who is employed or has been employed by the Company or any of its related corporations in the current or any of the past three financial years, and whose remuneration is or was determined by the Remuneration Committee of the Company. None of the Independent Directors has served the Board more than an aggregate period of nine years. For FY2023, the NC has assessed and is satisfied that the six Independent Directors are independent. Having considered the nature and scope of the Group’s businesses and the regulatory requirements, the NC and the Board are of the opinion that the current composition and size of the Board and its Board Committees are appropriate and adequate.

3. The Company has adopted a Diversity Policy in FY2022 that sets the framework for promoting diversity on the Board, recognising that it would enhance the Board’s decision-making process. The diversity which includes different skillsets, functional and industry expertise, international experience, gender, age, tenure, independence, ethnicity and culture, and other relevant factors, would provide various perspectives to the Board and thus better support the Company’s achievement of its strategic objectives, business requirements, risk management and internal controls.

4.The Group has a diverse Board of Directors with regional and international experience as well as expertise in a variety of disciplines and related fields. The Company has engaged with the Directors for their views in various areas of expertise to assist in, amongst others, the formulation and implementation of business objectives, processes and risk management. With the Board composition changes during FY2022, the Board was of the view that the new appointments provide further diversity to the core competencies and skill set of the Board. The current Board composition continues to reflect the Company’s commitment to Board diversity, especially in terms of female representation (18%), domain and industry expertise and diverse ethnicities (27%). This is beneficial to the Company and its management as decisions by, and discussions with, the Board are enriched by the broad range of views and perspectives and the breadth of experience of our Directors, avoiding groupthink and fostering constructive debate. The NC will apply the diversity guidelines adopted as and when it proposes new appointments for the Board’s consideration. The Board as guided by the NC, will continue to review the diversity of its members. Our current Women On Board (WOB) percentage of 18% is close to the 25% target set by the Council of Board Diversity. Our WOB percentage for Independent Directors is 33%. The Board will look to, at minimum, maintain and/or increase the number of female directors on its Board. Setting specific percentage diversity targets in the areas of gender, age and domain expertise will be considered, if required, in consultation with the NC.

5. The profile of each Director which includes key information regarding academic qualifications, directorships and chairmanships both present and those held over the preceding three years in other listed companies, and other principal commitments, is set out on pages 36 to 39 of this Annual Report. The details of the Directors’ shareholdings can be found under the section on Directors’ interests in shares and debentures on page 79 and 80 of the Directors’ Statement.

Principle 3: Chairman and Chief Executive Officer

1. The positions of the Chairman and Chief Executive Officer (“CEO”) are occupied by different people. Mr Ho KwonPing and Mr Eddy See Hock Lye each carries out his respective role as Executive Chairman and CEO of the Company. The Executive Chairman and CEO are not related. There is a clear division of responsibilities between the Chairman and the CEO, which is clearly set out in writing. Having clarity of their respective responsibilities and separating the respective roles avoids unfettered powers of decision-making, ensures a degree of checks and balances, increases accountability and ensures greater capacity of the Board for independent decision making.

2. The Executive Chairman, Mr Ho KwonPing, is responsible for leading the Board in charting the strategic direction and growth of the Group. He also facilitates the effective contribution of all Directors and ensures active and comprehensive Board discussions on Company matters, monitors the translation of the Board’s decisions into executive actions, and fosters constructive dialogue with shareholders and other stakeholders, including at each AGM. The Executive Chairman is also responsible for setting the agenda and ensuring that adequate time is available for discussion of all agenda items, in particular, strategic issues, promoting a culture of openness and debate at the Board, promoting and maintaining a high standard of corporate governance, and ensuring appropriate relations within the Board and between the Board and Management.

3. The execution of the Company’s corporate and business strategies and policies, and the conduct of the Group’s businesses is delegated to a dedicated team of Management comprising the CEO and the Managing Directors of the various Business Units. As President/CEO, Mr Eddy See leads management and the Group’s strategic business divisions and works together with the Board to formulate and execute the Group’s strategies, plans and processes. The CEO of the Company is accountable to the Board for the conduct and performance of the Group’s business operations.

4. The Board has appointed Mr Tan Chian Khong as the Lead Independent Director to lead and co-ordinate the activities of the Non-Executive Directors, and to provide leadership in situations where the Executive Chairman is conflicted. The Lead Independent Director is available to shareholders where they have concerns for which contact through the normal channels such as the Executive Chairman, the President/CEO or Management is inappropriate or inadequate and can be contacted via email at ethics@groupbanyan.com. The Lead Independent Director is also a member of the NC. The Lead Independent Director, meets with the other Independent Directors at least twice a year without the presence of the non-Independent Directors and Management. Appropriate feedback would be communicated by the Lead Independent Director to the Executive Chairman after such meetings. Through these meetings held in FY2023, there was no significant issue highlighted. The appointment or re-appointment of the Lead ID shall be reviewed by the Board from time to time.

Principle 4: Board Membership

1. The NC is chaired by Mr Paul Beh Jit Han and also comprises Mr Arnoud Cyriel Leo De Meyer, Mr Tan Chian Khong and Mr Ho KwonPing. Save for Mr Ho KwonPing who is the Executive Chairman, the remaining members of the NC are Independent Directors.

2. The key responsibilities of the NC most of which are set out in the Charter are as follow:

- setting the board diversity policy, including the targets, plans and timelines, for the Board’s approval;

- reviewing diversity targets, plans and progress against the objectives set out in the board diversity policy;

- the selection, appointment and re-appointment of Directors (including alternate directors, if applicable);

- reviewing and making recommendations to the Board on the structure, size and composition of the Board and Board Committees;

- reviewing and making recommendations to the Board on succession plans for Directors and members of senior management, in particular, for the Chairman of the Board and for the President/CEO and key management personnel (as defined in the Code) (“KMP”);

- reviewing and recommending a transparent process and criteria for evaluation of the performance of the Board and its committees, including assessing whether Directors are able to commit enough time to discharge their responsibilities and the maximum number of listed company board representations which a director may hold;

- reviewing and recommending objective performance criteria and process for the evaluation of the effectiveness of the Board as a whole, and of each Board Committee separately, as well as the contribution by the Chairman of the Board;

- ensuring continual training and professional development programs are put in place for the Board; and

- reviewing and confirming the independence of each Director annually, and as and when circumstances require

3. The NC’s selection process for candidates to be proposed to the Board for new appointments takes into account various factors including having the appropriate knowledge, experience and skills to contribute effectively, as well as the age and gender of the candidates, as may be determined by the NC to be relevant and how these would augment the Board and the Board Committees, particularly if the candidate is nominated to be in the Board Committees. Names of potential candidates are sought through networking contacts and recommendations. The NC shortlists candidates for nomination and recommends to the Board for approval. The re-appointment of Directors is based on their competencies, commitment and contributions, a review of the range of expertise, performance, skills and attributes of current Board members and the needs of the Board. The NC also reviews and makes recommendations to the Board on the training and professional development programmes for the Board and its Directors, and the review of succession plans for the Board and Management, in particular the appointment and/or replacement of the Chairman of the Board, the CEO and KMP. The NC also makes recommendations to the Board on the development of a process and criteria for evaluation of the performance of the Board, its Board Committees and Directors.

4. The SGX-ST Listing Rules requires every Director to submit themselves for re-nomination and re-appointment at least once every three years. The Constitution further requires one-third of the Directors (or, the number nearest to but not less than one-third) to retire by rotation and subject themselves to re-election by shareholders at every AGM. New Directors appointed by the Board during the year shall also submit themselves for re-election at the next AGM but shall not be taken into account in determining the number of Directors who are to retire by rotation at that AGM.

5.The names and additional information of the Directors who are seeking re-election at the forthcoming AGM to be held on 26 April 2024 are set out in this Annual Report.

6. The NC also determines the independence of the Directors annually as well as when circumstances change. The process includes the use of a self-assessment questionnaire which each Independent Director is required to complete and submit to the NC for review, in which each Director must disclose their relationships with the Company, its related corporations, its substantial shareholders and its officers, if any, which may affect their independence. In its annual review, the NC, having considered Rule 210(5)(d) of the SGX-ST Listing Rules, the principles and provisions set out in the Code (including Provision 2.1) and the Practice Guidance, has confirmed the status of the Directors as follows:

- Mr Ho KwonPing (Non-Independent)

- Mr Ho Ren Hua (Non-Independent)

- Mr Ding ChangFeng (Non-Independent)

- Mr Gaurav Bhushan (Non-Independent)

- Mr Abdulla Ali M A Al-Kuwari* (Non-Independent)

- Mr Tan Chian Khong (Independent)

- Mrs Karen Tay Koh (Independent)

- Mr Paul Beh Jit Han (Independent)

- Mr Arnoud Cyriel Leo De Meyer (Independent)

- Mr Lien Choong Luen (Independent)

- Ms Parnsiree Amatayakul (Independent)

* Mr Abdul Rahim bin Mohamed Ali is the Alternate Director to Mr Abdulla Ali M A Al-Kuwari.

7. The Board continues to have a majority of Independent Directors. Each of its current Independent Directors has been serving on the Board for between two (2) and five (5) years.

8. The Independent Directors have no affiliations or business relationships with the Company, its related corporations, substantial shareholders or officers, nor do any relationships or circumstances exist which are likely to, or could appear to, interfere with the exercise of their independent business judgement with a view to the best interests of BTH.

9. The Board has implemented a policy whereby the Executive Chairman’s external directorships should be approved by the NC. The Board also recognises the contributions of its non-executive directors who over time have developed deep insight into the Group’s businesses and operations. As the Board believes that these directors provide invaluable contributions to the Group, the Board has not determined the maximum number of listed company board representations which any Director may hold. The Board has allowed each Director to personally determine the demands of his/her directorships and obligations and to assess how much time he/she must dedicate in order to serve on the Board effectively. Each of the Directors updates the Company of any changes in his/her external appointments and these changes are noted at the Board meetings. Although some Directors have multiple board representations, the NC monitors and assesses annually the number of listed company board representations and the principal commitments of each of these Directors. For FY2023, the NC and the Board, having reviewed the multiple listed company board representations of the Directors and their principal commitments, are satisfied that each of these Directors has dedicated sufficient time and attention to, is able to perform and has adequately performed, his/her duties as a Director of the Company.

Principle 5: Board Performance

1.The NC has the responsibility of evaluating the Board’s and Board Committees’ effectiveness. The Company has in place a formal review process and objective performance criteria, which were formulated based on recommendations from the NC, for the Board’s assessment of the effectiveness of the Board as a whole, and of its Board Committees. The Board evaluation process involves each Director completing the Board Evaluation Questionnaire seeking his/her view on factors such as the structure, size and processes of the Board and the Board’s access to information, Management and external experts outside meetings, as well as the effectiveness of the Board as a whole, its Board Committees and the Board’s oversight of the Company’s performance. Performance criteria include skills, experience, independence, knowledge, diversity, as well as timeliness and quality of Board discussion and decision-making process.

2. For FY2023, the Board evaluation process was conducted internally. All Directors completed the Board Evaluation Questionnaire. Based on the compilation of responses by the Company Secretary, the NC evaluated the Board’s performance based on objective performance criteria such as open communication, meaningful participation and rigorous decision making. The Executive Chairman abstained from completing the Board Evaluation Questionnaire to provide independence to the overall results.

3. Each member of the NC abstained from making any recommendations and/or participating in any deliberation concerning the NC and voting on any resolution in respect of the assessment of his/her own performance or re-nomination as a Director to avoid any conflict of interests.

4. The Board, having reviewed the results of the Board evaluation as shared by the NC, was of the view that it had met its performance objectives for FY2023. To improve the overall effectiveness of the Board, it was agreed that Management shall promptly update the Board on key discussions and decisions made at the Board Committee levels.

(B) Remuneration Matters

Principle 6: Procedures for Developing Remuneration Policies

1. The RC consists of 3 members, namely Mrs Karen Tay Koh (RC Chair), Mr Paul Beh Jit Han and Mr Arnoud Cyriel Leo De Meyer. All members of the RC are Independent Directors.

2. The key responsibilities of the RC as set out in its Charter include making recommendations to the Board on key areas including:

- the review of the framework of remuneration for the Board and KMP and specific remuneration packages for each Director as well as for the KMP;

- the engagement of stakeholders with respect to remuneration matters; and

- implementation and administration of the Company’s share-based incentive plan(s) and other long-term incentive plan(s).

3. The RC reviews and makes recommendations to the Board on the level and structure of remuneration of the Board and KMP, to ensure they are appropriate and proportionate to the sustained performance and value creation of the Company, taking into account the strategic objectives of the Company, and appropriateness to attract, retain and motivate the Directors to provide good stewardship of the Company and KMP to successfully manage the Company for the long term. The RC takes into account all aspects of remuneration, including but not limited to, directors’ fees, salaries, allowances, bonuses, options, share-based incentives and awards, benefits-in-kind of the Board, KMP, and other executives who are related to the controlling shareholders and/or the Directors, and termination terms, to ensure they are fair. In particular, the RC reviews and makes recommendations to the Board on a framework of remuneration for the Board and KMP, and the specific remuneration packages for each Director as well as for executives who are related to the controlling shareholders and/or the Directors. The RC’s review of remuneration packages is submitted to the Board for its endorsement.

4. HR Guru, a human resource and executive level consultancy practice, was engaged to advise on the Company’s share incentive plans to ensure competitive compensation and progressive policies, with suitable and attractive long-term incentives, are in place. HR Guru’s lead consultant and HR Guru have no relationship with the Company which could affect their independence and objectivity in this regard. WTW, a global consulting firm that offers a suite of professional services, was also engaged to advise on benchmarking of Directors’ fees and Executive compensation. WTW also has no relationship with the Company which could affect their independence and objectivity in this regard.

5. No Director is involved in deciding his/her own remuneration or the remuneration of any employees who are related to him/her.

Principle 7: Level and Mix of Remuneration

Principle 8: Disclosure on Remuneration

1. A significant and appropriate proportion of the Executive Director’s and KMP’s remuneration is structured so as to link rewards to corporate and individual performance. Performance-related remuneration is aligned with the interests of shareholders and other stakeholders and promotes the long-term success of the Company. The employment contract of the Executive Chairman is automatically renewed every year, unless otherwise terminated by either party giving not less than six months’ notice in writing. The terms of the Executive Chairman’s employment contract do not provide for benefits upon termination of employment with the Company. The employment contracts of the Company’s KMP may be terminated by either party giving not less than three months’ notice in writing. There are no termination, retirement and post-employment benefits granted to the Directors, the Executive Chairman, the CEO and the top five KMP (who are not Directors or the CEO).

2. The remuneration framework for the Non-Executive Directors was evaluated by the RC, taking into consideration the level of contribution, effort, time spent, increasing responsibilities and obligations of these Directors, the prevailing market conditions, and referencing the Directors’ fees against comparable benchmarks. In respect of FY2023, the Board agreed with the RC’s recommendation that the existing fee structure for the Non-Executive Directors is appropriate. It was further agreed that said fee structure will be reviewed for FY2024. The Non-Executive Directors are paid by way of fees in cash. All Directors’ fees are subject to shareholders’ approval at the AGM. The framework for determining Directors’ fees is set out in Table 2 below:

Table 2

| Non-Executive Directors’ Fees | |

| Basic Retainer Fee | |

| Director | S$45,000 per annum |

Fee for Appointment as Lead Independent Director | S$20,000 per annum |

| Fee for Appointment to ARC | |

| ARC Chairman | S$44,000 per annum |

| ARC Member | S$22,000 per annum |

| Fee for Appointment to NC | |

| NC Chairman | S$20,000 per annum |

| NC Member | S$10,000 per annum |

| Fee for Appointment to RC | |

| RC Chairman | S$20,000 per annum |

| RC Member | S$10,000 per annum |

| Attendance Fee per Board Meeting | S$1,000 |

3. The Executive Chairman does not receive Directors’ fees from the Company but in FY2023 was paid Director’s fee from Laguna Resorts & Hotels Public Company Limited, a subsidiary of the Group. His remuneration comprises a base salary and bonus, from the Company as well as this listed subsidiary.

4. Table 3 below shows the gross remuneration of the Executive Chairman, Non-Executive Directors, the CEO as well as the top five KMP (who are not Directors or the CEO) for FY2023.

Table 3

| Name | Salary | Bonus | Other Benefits1 | Long-term Share-based Incentives | Directors’ Fees | Total remuneration |

| Executive Chairman | ||||||

| Ho KwonPing | 69.0% | 18.6% | 8.0% | 0% | 4.4%2 | S$1,847,000 |

| Non-Executive Directors | ||||||

| Tan Chian Khong | - | - | 2.96% | - | 97.04% | S$127,780 |

| Karen Tay Koh | - | - | 6.29% | - | 93.71% | S$97,105 |

| Paul Beh Jit Han | - | - | 8.19% | - | 91.81% | S$87,132 |

| Arnoud Cyriel Leo De Meyer | - | - | 12.22% | - | 87.78% | S$79,741 |

| Lien Choong Luen | - | - | 16.30% | - | 83.70% | S$86,020 |

| Parnsiree Amatayakul | - | - | 31.16% | - | 68.84% | S$72,634 |

| Gaurav Bhushan | - | - | - | - | 100.00% | S$48,000 |

| Ho Ren Hua | - | - | 4.85% | - | 95.15% | S$51,495 |

| Ding ChangFeng | - | - | - | - | 100.00% | S$47,000 |

| Abdulla Ali M A Al-Kuwari | - | - | 13.50% | - | 86.50% | S$56,648 |

| Abdul Rahim bin Mohamed Ali | - | - | - | - | 100.00% | S$1,000 |

| CEO | ||||||

| Eddy See Hock Lye | 71.5% | 16.3% | 9.0% | 1.7% | 1.5%2 | S$1,152,000 |

| Top 5 KMP3 | ||||||

| (immediate family members of Directors, in bands of S$100,000) | ||||||

| S$700,001 to S$800,000 | ||||||

| Ho KwonCjan | 65.2% | 17.4% | 11.0% | 0.0% | 6.4% | 100% |

| S$600,001 to S$700,000 | ||||||

| Claire Chiang | 72.9% | 19.0% | 8.1% | 0.0% | 0.0% | 100% |

| S$400,001 to S$500,000 | ||||||

| Ho Ren Yung | 69.2% | 16.2% | 9.0% | 0% | 5.6% | 100% |

| (other than immediate family members of Directors, in bands of S$250,000 | ||||||

| S$500,001 to S$750,000 | ||||||

| Stuart Reading | 62.8% | 26.1% | 6.2% | 2.1% | 2.8%2 | 100% |

| Dharmali Kusumadi | 71.9% | 18.8% | 6.7% | 2.6% | 0% | 100% |

- Including all benefits-in-kind such as provident fund contributions, complimentary accommodation, spa and gallery benefits, medical benefits, health checks, tax borne by the Company and home leave tickets, where applicable.

- Directors’ fees from Laguna Resorts & Hotels Public Company Limited (“LRH”).

- Paid by the Company and its subsidiaries.

5. The aggregate amount of remuneration paid to the top five KMP in FY2023 (who are not Directors or the CEO) is S$2,978,621.

6. As at 6 March 2024, there are two employees who are substantial shareholders of the Company and immediate family members of the Executive Chairman Mr Ho KwonPing, namely Mr Ho KwonCjan and Ms Claire Chiang. Mr Ho KwonCjan is the brother of Mr Ho KwonPing while Ms Claire Chiang, is the spouse of Mr Ho KwonPing. Ms Ho Ren Yung, who is part of the KMP, is the daughter of Mr Ho KwonPing and Ms Claire Chiang, and accordingly, an immediate family member of the Executive Chairman. Mr Ho Ren Hua, who is currently a Non-Executive Director, is the son of Mr Ho KwonPing and Ms Claire Chiang and the brother of Ms Ho Ren Yung. The disclosure of the remuneration for FY2023 of Ms Claire Chiang, Mr Ho KwonCjan and Ms Ho Ren Yung is made in bands of S$100,000 as shown above in Table 3. Mr Ho KwonPing and Mr Ho Ren Hua were not involved in the determination of their family members’ remuneration.

7. The Company adopts a remuneration framework for its KMP that is responsive to the market elements and performance of the Company and its various Business Units. The Company is transparent on its remuneration policies, level and mix of remuneration, the procedure for setting remuneration and the relationships between remuneration, performance and value creation. The Company’s remuneration policy comprises a fixed component, a variable component, a provident/superannuation fund, benefits-in-kind and long-term share incentives. The fixed component is in the form of salary whereas the variable component is in the form of various bonus and incentive payments which are linked to the Company’s and individual’s performance. The Company uses a balanced scorecard approach to align employee performance with the Group’s long-term strategy. The scorecard is used to set objectives, drive behaviours, measure performance and determine the remuneration of employees. The provident/superannuation fund comprises the Group’s contributions towards the Central Provident Fund or Zurich Provident Fund. The benefits-in-kind component includes spa and gallery vouchers issued by the Company to its employees.

Long-Term Share Incentives

8. The RC sets the remuneration guidelines of the Group for each annual period including the Company’s share-based incentive schemes. The Company adopted the Banyan Tree Share Award Scheme 2016 (“Share Award Scheme”) at the AGM held on 28 April 2016. The Share Award Scheme, which is the only share-based incentive scheme currently in force, will be in force for a maximum of 10 years beginning from 28 April 2016.

9. The Share Award Scheme is intended to strengthen the Group’s competitiveness in retaining and attracting talented key executives. The Share Award Scheme is also aimed at aligning the interests of key executives with that of shareholders, improving performance and achieving sustainable growth for the Company, and fostering an ownership culture among key executives. Under the rules of the Share Award Scheme, participants may be granted fully-paid shares or their cash equivalent, when and after pre-determined performance and service conditions are met. The selection of a participant and the number of shares to be awarded under the Share Award Scheme are determined at the discretion of the RC. The RC reviews and sets the performance conditions and targets as appropriate and after considering prevailing business conditions. HR Guru provided the valuation and vesting computation for the share grants awarded under the Share Award Scheme. Details of the Share Award Scheme, including the terms and performance conditions, can be found in the Directors’ Statement and Note 43 to the financial statements.

10. For FY2023, 214,000 treasury shares were transferred due to the release of share awards vested under the Share Award Scheme. In addition, an initial award of 1,143,750 shares with a potential to acquire an additional award of 796,875 shares (aggregating a total award of 1,940,625 shares) was granted under the Share Award Scheme, subject to pre-determined performance conditions being met.

(C) Accountability and Audit

Principle 9: Risk Management and Internal Controls

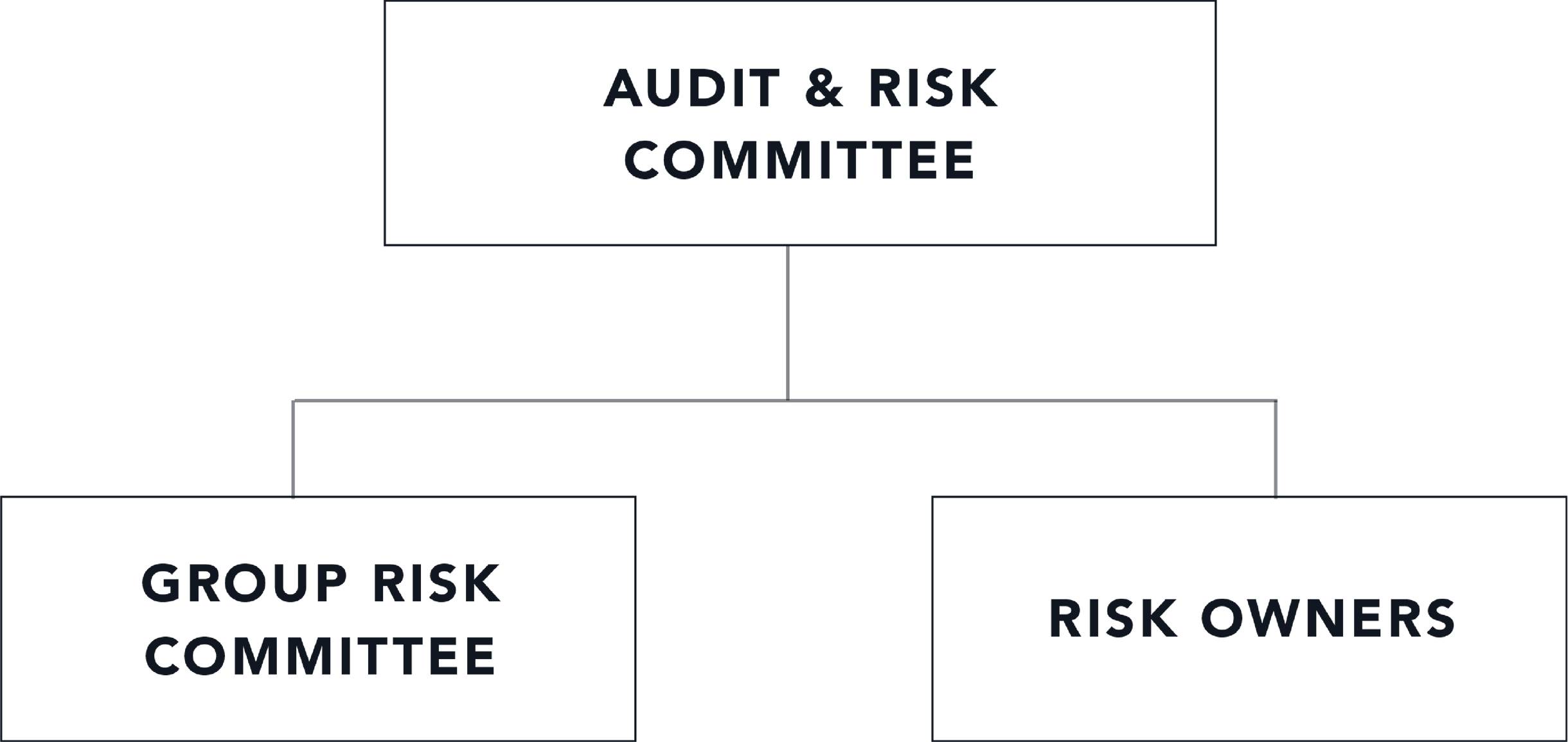

1. The Board is responsible for the governance of risk, including determining the nature and extent, of the significant risks which the Company is willing to take in achieving its strategic objectives and value creation. The Board ensures that Management maintains a sound system of risk management and internal controls, to safeguard the interests of the Company and its shareholders. During the year, the ARC assisted the Board in the oversight of the Group’s risk management processes and activities to mitigate and manage risk at levels that are determined to be acceptable to the Board. The ARC is assisted by the Group Risk Management Committee which is not a Board Committee and comprises Senior Management. The Group Risk Management Committee meets on a regular basis and its meetings are attended periodically by the heads of the relevant Business Units of the Group. The Group Risk Management Committee monitors, manages and reports on the Group’s strategic and business risks and the measures taken to address them. On a quarterly basis, all significant risks to the Group and/or properties which have been identified and managed are highlighted at the ARC meetings.

2. The Board has approved a risk framework for the identification of key risks within the business known as the Committee of Sponsoring Organizations of the Treadway Commission Internal Control – Integrated Framework (COSO Framework) for assessing the adequacy and effectiveness of BTH’s internal control systems.

3. The Group has refreshed its Enterprise Risk Management (“ERM”):

- reviewing existing risk management and reporting processes;

- reviewing and updating risk universe and risk parameters; and

- establishing key risk indicators.

4. The ERM Framework for FY2023 has incorporated ESG criteria and factors, in addition to climate risks. For 2023, the Board considers climate change a key material risk. As set out in its Sustainability Report (to be issued by the end of April 2024) for FY2023, the Group has finalised its strategic development of a decarbonisation strategy in line with the World Travel and Tourism Council’s Net Zero Roadmap (November 2021) and the Taskforce for Climate Related Financial Disclosure’s Recommendations.

5. The ERM Framework categories various risks into five key categories: i) Operational; ii) Technological; iii) Compliance; iv) Finance; and v) Strategic. The ERM Framework also incorporates a continuous and interactive process for identifying and evaluating the various risks and formulating controls and procedures to manage identified key risks in the Group.

| Material Risk | Key mitigating actions | Opportunities |

| Operational Risk |

| New guest segments introduced to any of the brands under the Banyan Group. |

| Technological Risk |

| Explore new technologies to enhance operations and guest experience |

| Compliance Risk |

| Opportunities for improvements as we continue to comply with the new and changing regulations. |

| Financial Risks |

| Improvements in the financial increase investor confidence and in a better position for new investments. |

| Strategic Risks |

| With 12 brands under the Banyan Group targeting various customer segments provides various avenues for expansion into new growth markets. |

6. Management, through the Group Risk Management Committee, is responsible for the effective implementation of risk management strategy, policies and processes to facilitate the achievement of business plans and goals. The identification and management of risks lie with the respective Business Units and Management which assume ownership and day-to-day management of these risks. Key business risks are proactively identified, addressed and reviewed on an ongoing basis. This includes reviewing the level of business risks associated with the Group’s strategy and the appropriate framework and policies for Management that are consistent with BTH’s risk appetite. Risk registers are maintained by these operating Business Units that identify the key risks facing the Group’s businesses and the internal controls in place to manage such risks.

7. The ARC provides oversight of the financial reporting risk and the adequacy and effectiveness of the Group’s internal control and compliance systems. The ARC also reviewed the effectiveness of the measures taken by Management including the review of adequacy and timelines of the actions in response to the recommendations made by the Head of Group Internal Audit and External Auditor. The system of internal control and risk management is continually being refined by Management, the ARC and the Board, and is reviewed at least annually.

8. The Board reviews at least annually the adequacy and effectiveness of the Company’s internal controls and risk management systems. The system of internal controls and risk management established by Management provides reasonable assurance that BTH will not be adversely affected by any event that can be reasonably foreseen as it strives to achieve its business objectives. In relation to the interim financial statements, the Board provides a negative assurance confirmation to shareholders in line with the requirements of the SGX-ST Listing Rules.

9. The Board has also received written assurance from the Executive Chairman and the President/CEO together with the Head of Group Finance & Corporate Affairs that the financial records of BTH have been properly maintained and the financial statements for FY2023 give a true and fair view of the Group’s operations and finances. The Board has also received assurance from the Executive Chairman, the President/CEO, the Head of Group Finance and Corporate Affairs, and the Group Risk Committee that the system of risk management and internal controls in place within BTH is adequate and effective in addressing the material risks of the Group in its current business environment, including material financial, operational, and compliance risks including information technology risks and sustainability risks.

10. Based on the framework established and the annual review conducted by the Management, Head of Group Internal Audit, and the External Auditor, as well as the assurance from the President/CEO, the Head of Group Finance and Corporate Affairs and the relevant key management personnel, the Board, with the concurrence of the ARC, is of the view that the Group’s internal controls (including financial, operational, compliance and information technology controls) and risk management systems were adequate and effective to address financial, operational, compliance and information technology risks which the Group considers relevant and material to its current business environment.

Principle 10: Audit and Risk Committee

1. The ARC has, among others, the following roles and responsibilities as set out in the Charter approved by the Board:

- review and recommend to the Board the Company’s risk strategy, risk appetite, levels of risk parameters and risk policies to be reflected in the risk appetite statement that has been approved by the Board within the risk framework;

- oversee Management in the design, implementation and monitoring of the risk management and internal control systems and processes. This includes identifying weaknesses and recommending areas for improvement and activities to mitigate and manage risk at levels that are determined to be acceptable to the Board;

- review, monitor and report to the Board the financial, operational, compliance and information technology risks identified by Management, and the effectiveness of the mitigating measures put in place by Management;

- oversee the risk process and advise the Board on the current and future exposure to financial, operational, compliance and information technology risks;

- review reports on any material breach of risk limits and the adequacy of proposed action, reporting on the results to the Board;

- review, at least annually, the adequacy and effectiveness of the risk management function, including the plans, activities, staffing, budget, resources and organizational structure;

- review risk management capabilities across the Group including risk identification, risk systems, risk management training, risk communication channels, crisis readiness and recovery capabilities;

- monitor the integrity of the financial reports prepared by Management, in particular by reviewing the relevance and consistency of the accounting standards used at company level and at group level;

- review significant financial reporting issues and judgments so as to ensure the integrity of any financial information, including financial statements of the Group and any announcements relating to the Group’s financial performance;

- review the assurance provided by the Executive Chairman, President/CEO and the Head of Group Finance and Corporate Affairs that the financial records have been properly maintained, and that the financial statements give a true and fair view of the Group’s operations and finances;

- review at least annually the adequacy and effectiveness of the Company’s internal control and risk management systems (including financial, operational, compliance and information technology controls), and state whether the ARC concurs with the Board’s comment on adequacy and effectiveness of the Company’s risk management and internal control systems as required by Rule 1207 (10) of the SGX-ST Listing Rules. These may include reviewing management reports and/or assurance provider reports (e.g. external audit and internal audit reports) to identify any material weaknesses and the steps taken by Management to address them;

- review disclosures in the annual report relating to the adequacy and effectiveness of all aspects of the risk management and internal control systems;

- review the assurance provided by the President/CEO and the Vice President, Head of Group Finance and Corporate Affairs on the effectiveness of risk management and internal control;

- review the internal audit reports, and the adequacy, effectiveness, independence, scope and results of the Company’s internal audit function;

- assess the external auditors’ adequacy and effectiveness and review the results of the external audit;

- make recommendations to the Board on the proposals to shareholders on the appointment, re-appointment and removal of the external auditors;

- review the remuneration and terms of engagement of the external auditors and make recommendations to the Board for approval;

- review and pre-approve (which may be pursuant to pre-approval policies and procedures) both audit and non-audit services to be provided by the external auditors. The ARC delegates to Management the authority to approve a list of non-audit services based on a pre-determined threshold. Management will present the list of non-audit services engaged to the ARC at its scheduled meetings; and

- monitor and assess annually whether the external auditors’ independence or objectivity is impaired (with the provision of permissible non-audit services) The factors to consider include the amount of fees paid to the external auditors for the financial year, and the breakdown of aggregate fees for audit and non-audit services provided by the external auditors.

2. The ARC, chaired by Mr Tan Chian Khong, also comprises Mrs Karen Tay Koh and Mr Lien Choong Luen, all of whom are Independent Directors. The Board considers that Mr Tan, a qualified Chartered Accountant, who has extensive, recent, relevant and practical accounting and financial management knowledge and experience, is well qualified to chair the ARC. The other members of the ARC, Mrs Koh and Mr Lien, have collective expertise and experience in banking, healthcare, technology and related financial management, and are qualified to discharge their responsibilities as ARC members. The members of the ARC collectively have strong accounting and related financial management expertise and experience and are kept abreast of relevant changes to the accounting standards and issues which have a significant impact on the financial statements through regular updates from the External Auditor during the year. The ARC does not comprise former partners or directors of the Company’s External Auditor (a) within a period of two years commencing on the date of their ceasing to be a partner or director of the External Auditor, or (b) who have any financial interest in the External Auditor. Further responsibilities of the ARC are detailed under the Directors’ Statement in the Annual Report.

3. The ARC meets with the Head of Group Internal Audit and the External Auditor without the presence of Management twice a year. These meetings enable both the Head of Group Internal Audit and the External Auditor to raise issues encountered in the course of their work directly to the ARC without presence of management.

4. The ARC reviews, with the Head of Group Internal Audit and the External Auditor, their audit plans, the system of internal controls, audit reports, the management letters and the Company’s management response. The ARC also reviews the periodic and full-year results, as well as financial statements of the Company and the Group before submission to the Board for its approval. Emphasis is placed on changes in accounting policies and procedures, as well as major operating risk areas. In addition, the ARC appraises the Group’s risks on an integrated basis, including all matters affecting the Group’s performance and the effectiveness of the Group’s key internal controls over financial, operational, compliance and information technology controls. The ARC also reviews all interested person transactions.

5. The ARC commissions and reviews the findings of internal investigations into matters of suspected fraud, irregularity, failure of internal controls, and the infringement of any law, rule or regulation, where necessary.

6. The ARC also reviews the Group’s Whistle-Blowing Policy and arrangements and all significant whistleblowing cases; which sets out the procedure to make a report on possible or suspected misconduct or wrongdoing relating to the Group by a whistleblower. A whistleblower could be an employee, officer, Director, customer, supplier, contractor, agent or any member of the public. Under the Whistleblowing Policy, all employees and officers of the Group have the responsibility to promptly report any misconduct or wrongdoing involving suspected fraud, corruption, other illegal or unethical practices or other similar matters which may cause financial loss to the Group or damage the Group’s reputation. The Whistle-Blowing Policy, including the dedicated whistle-blowing hotline at (+65) 6849 5706 and email address at ethics@groupbanyan.com, are made available on BTH’s website. Anonymous disclosures will be accepted and anonymity and confidentiality will be honoured throughout the process. The ARC is satisfied that arrangements are in place for the independent investigations of such improprieties and for appropriate follow-up actions and resolutions.

7. The Group has a Code of Corporate Conduct and Ethics Policy (including Conflicts of Interest) put in place by the Board which sets out the principles and standards of conduct expected of all its Directors and employees to carry out their duties with honesty, fairness, integrity and professionalism. This Code is published on the intranet. Standard operating policies have also been adopted by the Group’s various business and operating units to ensure that procedures have been adopted to promote anti-corruption practices, including:

- the Group’s agreements/contracts with its business partners are to be lawful, fairly arrived at and fully documented in writing, and where appropriate, cleared by the Group’s in-house Legal Counsel; and

- associates are to act with honesty and integrity in all dealings with the government, businesses and other organisations and are not to offer gifts, gratuities, or non-business-related entertainment to unduly influence any employee of business partners that are transacting with the Group to make a business decision in the Group’s favour.

8. The ARC has explicit authority to investigate any matters within its Charter and has full access to the co-operation of Management and full discretion to invite any Director or Management personnel to attend its meetings. The Company’s Internal Audit team, together with the External Auditor, reports its findings and recommendations independently to the ARC. The ARC also reviews and considers the performance and compensation of the Head of Group Internal Audit as well as her independence from Management. In FY2023, the ARC assessed the strength of the Internal Audit team and confirmed that the Internal Audit function is independent and effective and that the Internal Audit team is adequately resourced and suitably qualified to discharge its duty.

9. The ARC has undertaken a review of the nature and extent of all non-audit services performed by the External Auditor during the year. Based on this review and other information, the ARC is satisfied and is of the view that such services have not affected their independence. It recommends the re-appointment of the External Auditor. To further maintain the independence of the External Auditor, the ARC ensures that the audit partner in charge of the Group is rotated every five years. The ARC approved the remuneration and terms of the engagement of the External Auditor. The details of the aggregate amount of fees paid to the External Auditor for FY2023 and the breakdown of fees paid in total for audit and non-audit services respectively can be found in the Annual Report. In addition, the ARC also reviewed the appointment of different auditors for its subsidiaries or significant associated companies to ensure that the appointment would not compromise the standard and effectiveness of the audit of the Company or its subsidiaries or significant associated companies. The date of appointment and name of the audit partner in charge of the Group’s audit can be found in the Annual Report. Also, the names of the auditing firms for its significant subsidiaries and associated companies can be found in the Annual Report.

10. In the opinion of the Directors, the Group complies with the Code’s provisions on audit committees as well as Rules 712, 715, 716 and 717 of the SGX-ST Listing Rules.

11. In the review of the financial statements for FY2023, the following significant matters impacting the financial statements were discussed with Management and the External Auditor, and were reviewed by the ARC:

| Significant matters | How the ARC reviewed these matters and what decisions were made |

| Fair value measurement of investment properties and freehold land and buildings | The ARC considered the appropriateness of the approach and methodology applied to the valuation model in assessing the valuation of the investment properties and freehold land and buildings as well as the independence, objectivity and competence of the external property valuers appointed to perform the valuation. The ARC reviewed the reasonableness of the valuation basis and the key inputs used in the valuation model, taking into consideration any significant changes in market and economic conditions. The valuation of the investment properties and freehold land and buildings was also an area of focus for the External Auditor. The External Auditor has included this item as a key audit matter in its audit report for FY2023 in this Annual Report. |

| Acquisition of Banyan Tree Hotel Management (China) Pte Ltd (“BTMC”) and Banyan Tree Services (China) Pte Ltd (“BTSC”) | The ARC consider the appropriateness of the approach and methodology used to account for the acquisition as well as the independence, objectivity and capabilities of the valuation specialist engaged to determine the acquisition date fair value of the previously held equity interest in the acquirees and the resulting goodwill. |

12. The Internal Audit is an independent function within the Company. The Internal Audit Department (“IAD”) has unfettered access to all the Company’s documents, records, properties and personnel, including access to the ARC, and has appropriate standing within the Company. The Head of Group Internal Audit reports directly to the ARC with a dotted-line relationship to the Chief Executive Officer for administrative matters. The ARC decides on the appointment, termination and remuneration of the Head of Group Internal Audit. The ARC also reviews annually the adequacy, effectiveness, independence, scope and results of the external audit and the Company’s internal audit function.

13. The IAD is staffed by suitably qualified professional staff with the requisite skill sets and experience. Recruitment efforts are ongoing to establish the full team of ten audit executives, including the Head of Group Internal Audit.

14. The IAD assists the ARC and the Board by performing regular evaluations of the Group’s internal controls, information technology, financial and accounting matters, compliance, business and risk management policies and procedures and ensuring that internal controls are adequate to meet the Group’s requirements.

15. On a quarterly basis, the ARC reviews the IAD’s reports, summary of findings and recommendations at the ARC meetings. The ARC also reviews and approves the annual internal audit plan which is determined in consultation with, but independent of, Management. The proposed scope of the internal audit function under the categories of financial audit, operational audit and information technology audit focuses on the adequacy and effectiveness of internal controls in relation to financial, operational and information technology risks. In addition, IAD will review relevant processes relating to sustainability reporting at selected properties to assess the quality of data being produced and reported.

(D) Shareholder Rights and Engagement

(E) Managing Stakeholders Relationships

Principle 11: Shareholder Rights and Conduct of General Meetings

Principle 12: Engagement with Shareholders

Principle 13: Engagement with Stakeholders

1. The AGM held on 28 April 2023 was conducted and held by electronic means pursuant to the COVID-19 (Temporary Measures) (Alternative Arrangements for Meetings for Companies, Variable Capital Companies, Business Trusts, Unit Trusts and Debenture Holders) Order 2020. In line with the alternative arrangements prescribed in the said Order, shareholders were able to view the AGM through both audio-visual webcast and live audio-only stream, as well as to send substantial and relevant questions relating to the agenda of the AGM to the Company in advance of the AGM (for which the Company’s answers were published in an announcement and posted on the corporate website), and to cast their votes through appointing the Chairman of the AGM as their proxy. Given the revocation of the COVID-19 (Temporary Measures) (Alternative Arrangements for Meetings for Companies, Variable Capital Companies, Business Trusts, Unit Trusts and Debenture Holders) Order 2020, the Company will be holding its upcoming AGM in a physical manner.

2. The discussion below describes the Company’s usual approach towards enabling shareholders to effectively participate at general meetings which are customarily conducted in a physical manner.

3. All BTH shareholders are treated fairly and equitably in order to enable them to exercise their ownership rights. Shareholders are given opportunities to participate effectively in and vote at general meetings of shareholders and to communicate their views on matters affecting the Company. The Company informs shareholders of the rules, including voting procedures, governing such meetings.

4. All shareholders of the Company are entitled to receive notices of general meetings, which are also published in the Business Times and posted on the SGXNET. The Notice of AGM, the Annual Report 2023 and other related documents were distributed to shareholders 21 days before the AGM to provide sufficient time for review. Shareholders are also given the opportunity to ask written questions within a reasonable time prior to the AGM.

After the Notice of AGM is distributed, shareholders are allowed at least seven (7) calendar days to submit their written questions. In respect of written questions submitted before the cut-off time, the Company seeks to respond to substantial and relevant written questions prior to the general meeting through publication on SGXNET and the Company’s corporate website at least 48 hours prior to the closing date and time for the lodgement of proxy votes, to facilitate shareholders’ votes. If written questions or follow-up written questions are submitted after the cut-off time, the Company will seek to respond to these substantial and relevant written questions prior to or at the AGM. A copy of the AGM documents are also available on our corporate website at https://www.groupbanyan.com/investor-relations. The Board recognises that the AGM is an important forum at which shareholders can communicate their views and raise any relevant queries with the Board and Management regarding the Company and its operations. The Company is in full support of shareholders’ participation at the AGM. The Board and Management are in attendance at the AGM to address questions by shareholders. The External Auditor and legal advisers are also present to assist the Directors in addressing shareholders’ queries relating to the conduct of the audit and the preparation and content of the auditor’s report, as well as clarify any points of law, regulation or meeting procedure that may arise. Chairman may direct certain directors, such as the Lead Independent Director and the ARC Chairman to answer queries on matters related to their roles. The Directors, particularly the Chairman, take the opportunity to interact with shareholders after the AGM, addressing their queries informally.

5. At general meetings, each substantially separate issue is tabled for approval by shareholders in a separate resolution unless the issues are interdependent and linked so as to form one significant proposal. Where the resolutions are “bundled”, the Company explains the reasons and material implications in the notice of meeting. After each resolution has been tabled, shareholders can raise questions, participate and communicate their views relating to the matter before it is put to a vote. In support of greater transparency and to allow for an efficient voting system, the Company has during the year opted for electronic poll voting for all resolutions tabled at the AGM. An independent external party is appointed as scrutineer to conduct the AGM voting process, which is independent from the firm appointed to undertake the electronic poll voting process. The results of the electronic poll voting showing the number of votes cast for and against each resolution and the respective percentages are announced at the AGM immediately after each resolution is voted on, and the outcome is published on SGXNET on the same day.

6. Provision 11.4 of the Code provides that a company’s constitution should allow for absentia voting at general meetings of shareholders. The Constitution of the Company allows for absentia voting at general meetings, where shareholders may exercise their right to vote through the appointment of a proxy, attorney or in the case of a corporation, the appointment of a corporate representative.

7. A registered shareholder may appoint one or two proxies to attend the AGM and vote. Under the Companies Act, a member which is a relevant intermediary (as defined in the Companies Act), which generally includes Singapore banks and nominee or custodial service providers, as well as the Central Provident Fund Board, may appoint more than two proxies to attend, speak and vote at the AGM, provided that each appointed proxy represents a different share or shares held by such member.

8. The Constitution provides that documents to be sent to shareholders can be sent via electronic communications. Accordingly, the Company has made available a digital format of the Annual Report together with a copy of the notice of AGM and proxy form as well as the Company’s Letter to Shareholders on its corporate website at https://www.groupbanyan.com/investor-relations. All shareholders will receive a copy of the notice of AGM, proxy form and request form for hard copies of the Annual Report and/or Letter to Shareholders. The Company will also publish its minutes of general meetings, which record substantial and relevant comments or queries from shareholders relating to the agenda of the general meeting, and responses from the Board and Management, on its corporate website at https://www.groupbanyan.com/investor-relations.

9. The Company’s Dividend Policy seeks to maximise shareholder value and encourage shareholder loyalty with predictable annual growth in dividend pay-out which is not impacted by profit volatility. With that objective, the Company’s Dividend Policy is based on the principles of stability, predictability and managed growth, and is outlined as follows:

- Stability

Unless the Company suffers a substantial net loss, it will pay a dividend each year so that shareholders are not negatively affected by annual profit volatility. - Predictability

Shareholders will be able to better anticipate the appropriate level of dividends to expect each year and therefore may be better able to manage their portfolio investment strategy. - Managed growth

The Company will strive to increase and smooth out the dividends year on year within a broad band but the specific rate will be dependent on the Company’s actual profit performance, cash and cash flow projections.

10. Operating performance of the Group’s hotels had improved progressively in 2023. Consequently, for the financial year ended 31 December 2023, the Board of Directors has recommended the payment of a first and final tax exempt (one-tier) dividend of 1.20 cents per ordinary share.

11. The Company has in place an investor relations policy which serves to provide high quality, meaningful and timely information to improve the shareholders’ and investors’ understanding of the Company, and allows for an ongoing exchange of views so as to actively engage and promote regular, effective and fair communication with shareholders. It adopts the practice of regularly communicating major developments in its businesses and operations through SGXNET and, where appropriate, directly to shareholders, other investors, analysts, the media, the public and its employees. For FY2023, the Company held a media and analysts’ briefing upon the release of its full-year results. These releases were also made available on the Company’s website, https://www.groupbanyan.com/investor-relations.

12. To allow the Company’s shareholders to communicate their views on various matters affecting the Company, and in order to solicit and understand the views of shareholders, the Company has an investor relations team (“IR Team”) that communicates with its shareholders and analysts regularly and attends to their queries. The IR Team also manages the dissemination of corporate information to the media, the public, as well as institutional investors and public shareholders, and promotes relations with and acts as liaison for such entities and parties.

13. As part of its overall responsibility to ensure that the best interests of the Company are served, the Board adopts an inclusive approach by considering and balancing the needs and interests of material stakeholders. As part of the Company’s strategy in managing stakeholder relationships, the Company has put in place arrangements to identify and engage with its material stakeholder groups and to manage its relationship with such groups. Such stakeholders include property buyers, hotel guests, employees, contractors, suppliers, government, the community and investors.

14. For more information on the Company’s stakeholder engagement, please refer to the Company’s 2023 Sustainability Report (to be issued by the end of April 2024). Other details in relation to the Company’s approach to sustainability can be found in the Annual Report.