OUR BUSINESS

IN BRIEF

Key Figures

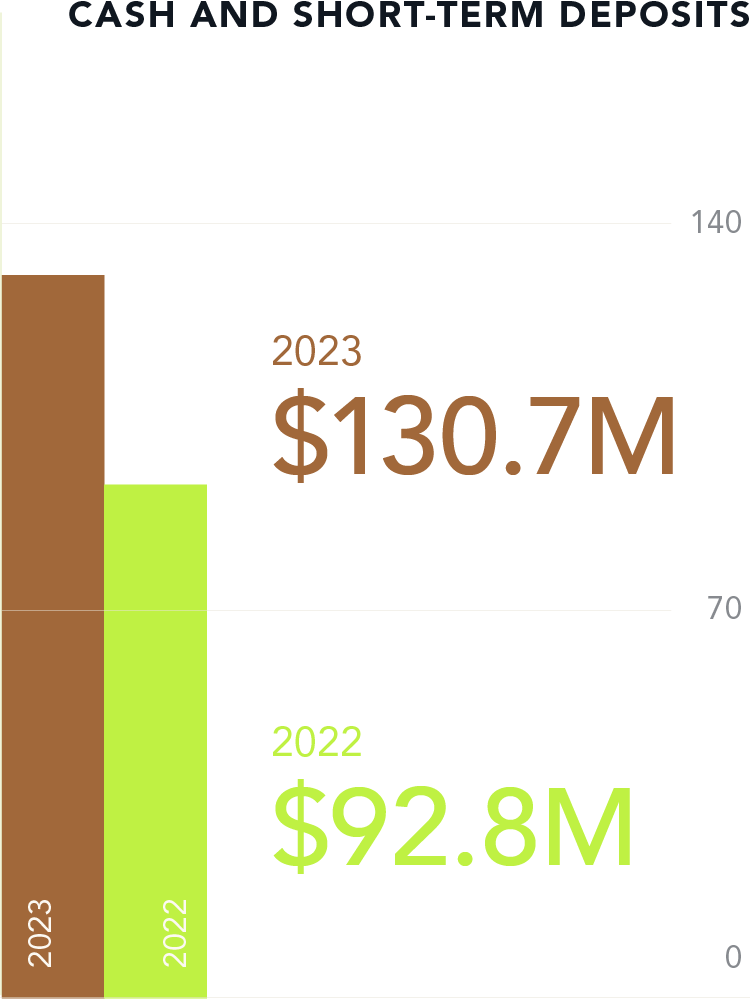

Five-Year Financial Highlights

| 2019 S$m | 2020 S$m | 2021 S$m | 2022 S$m | 2023 S$m |

|

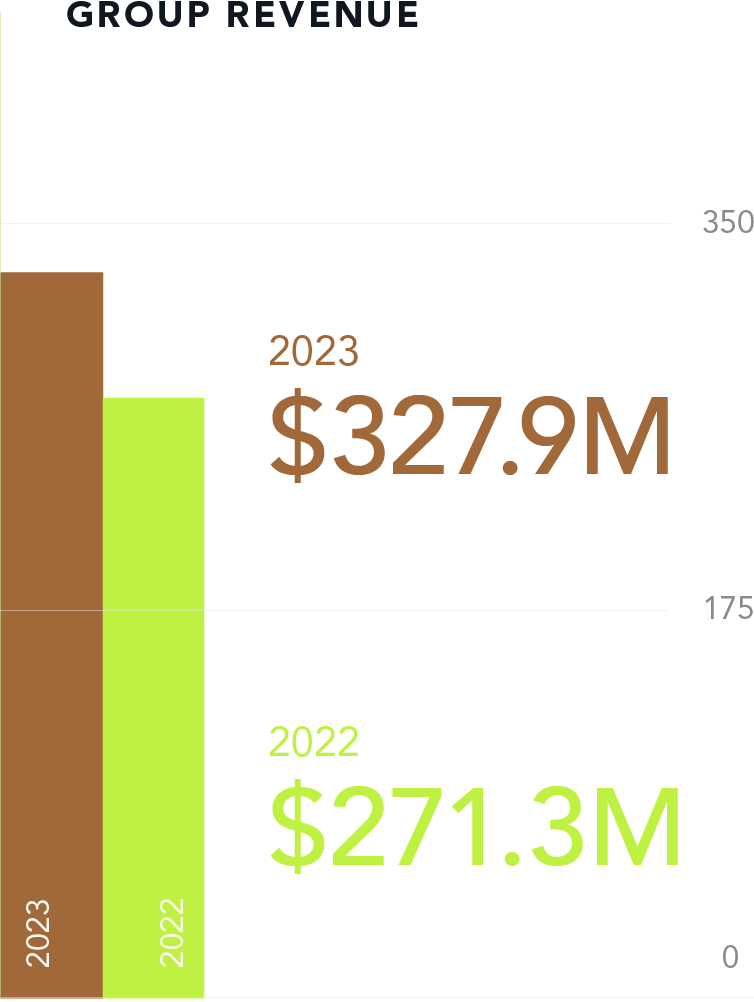

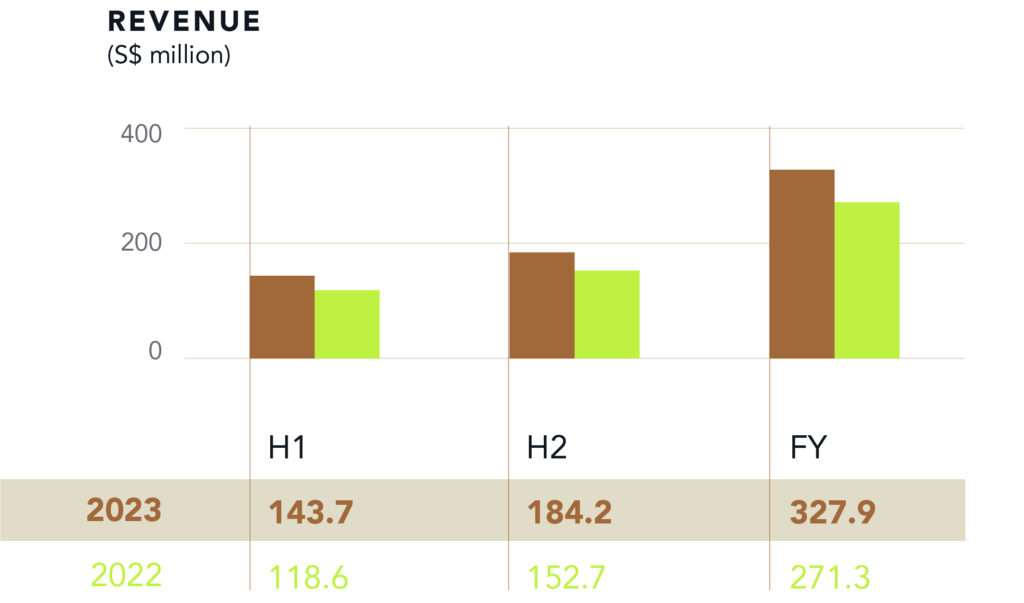

| Revenue | 347.0 | 157.8 | 221.2 | 271.3 | 327.9 |

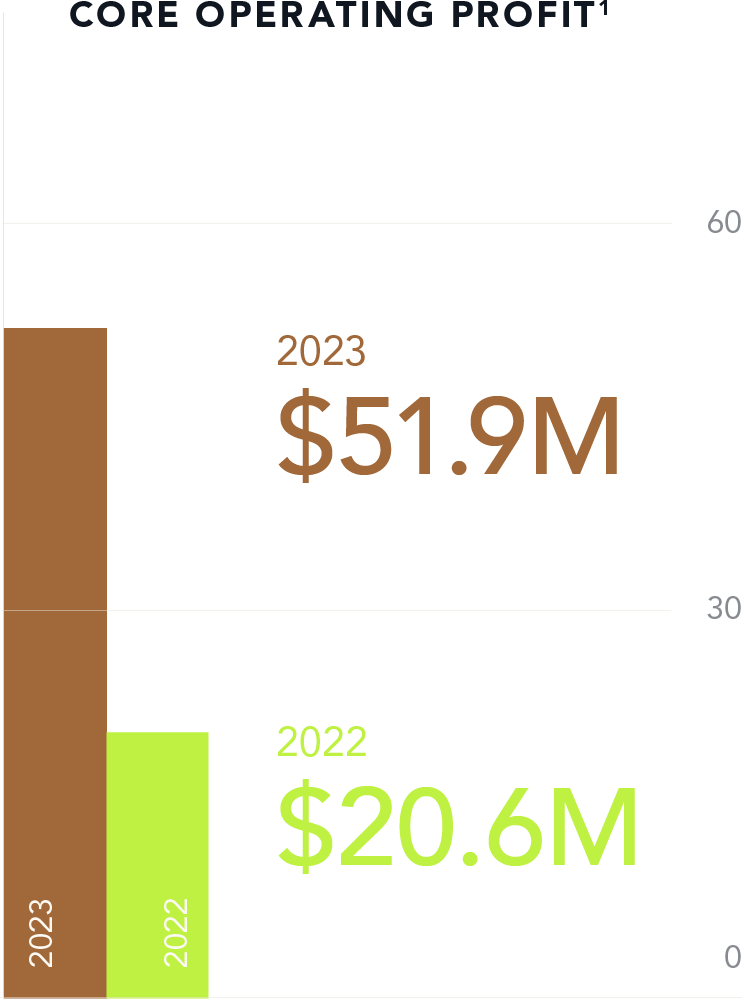

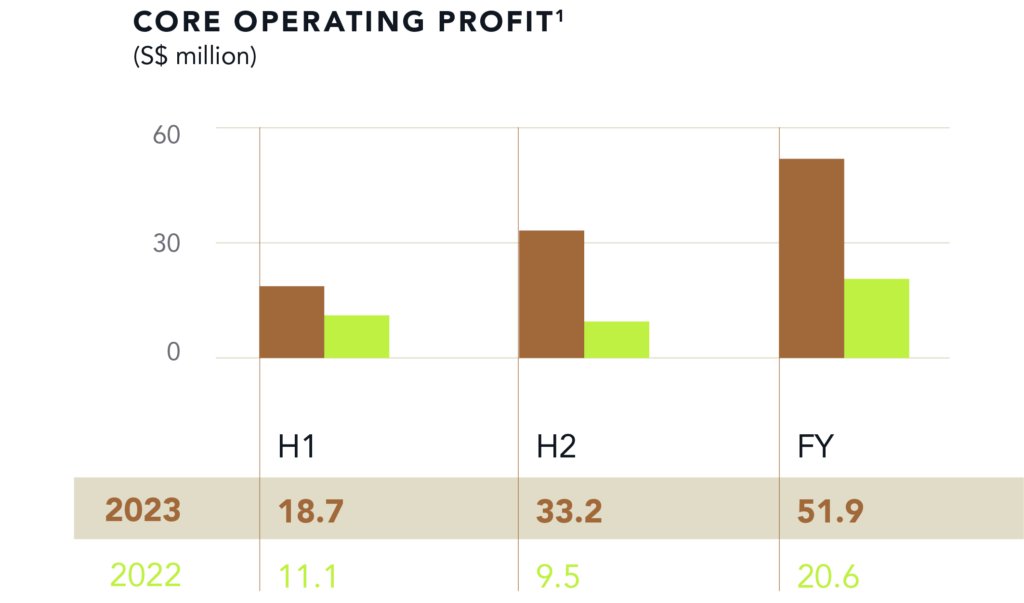

| Core Operating Profit 1 | 65.1 | 4.3 | 5.3 | 20.6 | 51.9 |

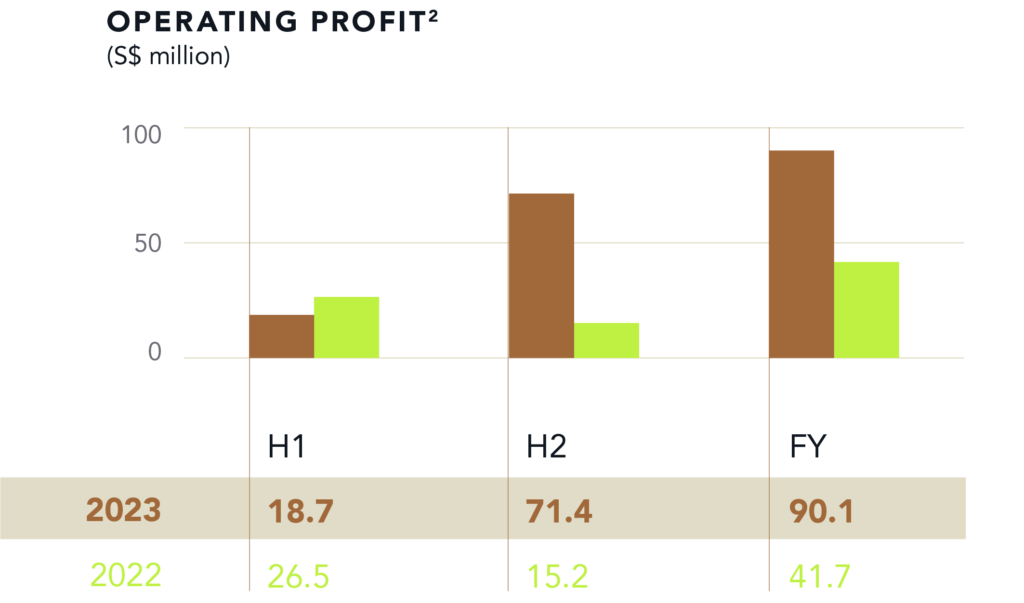

| Operating Profit/(Loss) 2 | 56.2 | (35.1) | 4.5 | 41.7 | 90.1 |

| Profit/(Loss) before tax (PBT) | 14.0 | (94.6) | (51.8) | 1.3 | 42.6 |

| Profit/(Loss) after tax (PAT) | 2.5 | (102.5) | (61.3) | 0.6 | 32.9 |

| Profit/(Loss) after tax & minority interests (PATMI) | 0.7 | (95.8) | (55.2) | 0.8 | 31.7 |

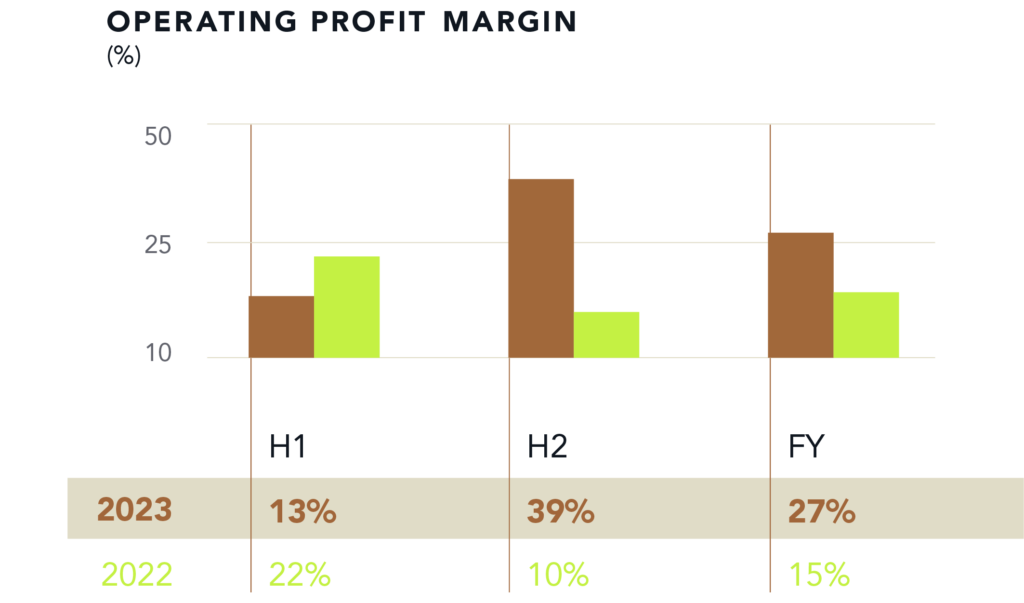

| Operating Profit/(Loss) Margin | 16% | (22%) | 2% | 15% | 27% |

| Per share ($) | |||||

| • Basic earnings | 0.001 | (0.114) | (0.065) | 0.001 | 0.037 |

| • Diluted earnings | 0.001 | (0.114) | (0.065) | 0.001 | 0.037 |

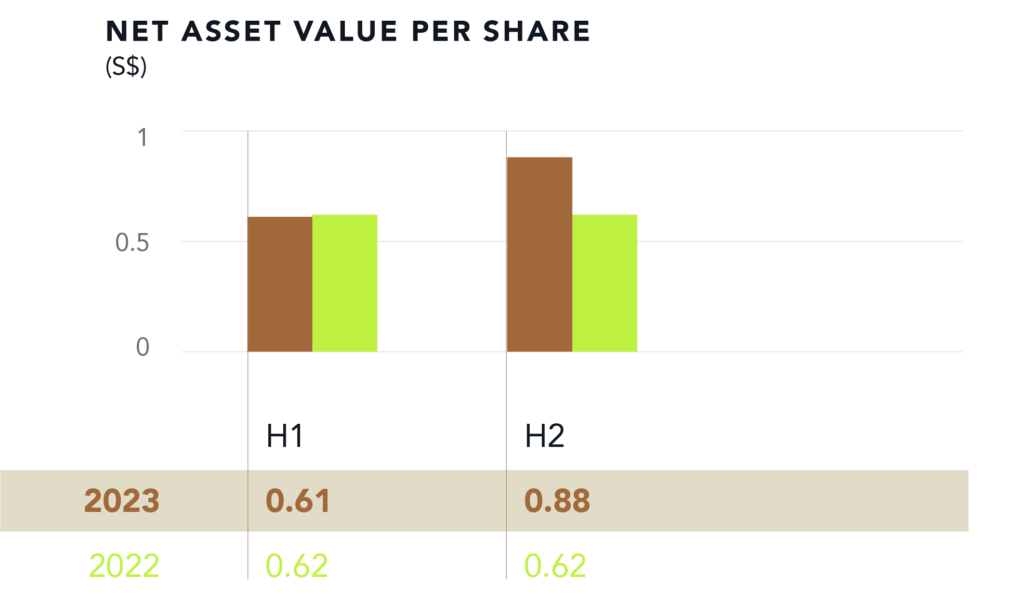

| • Net assets | 0.890 | 0.746 | 0.627 | 0.615 | 0.882 |

| Net debt equity ratio | 0.57 | 0.72 | 0.59 | 0.46 | 0.27 |

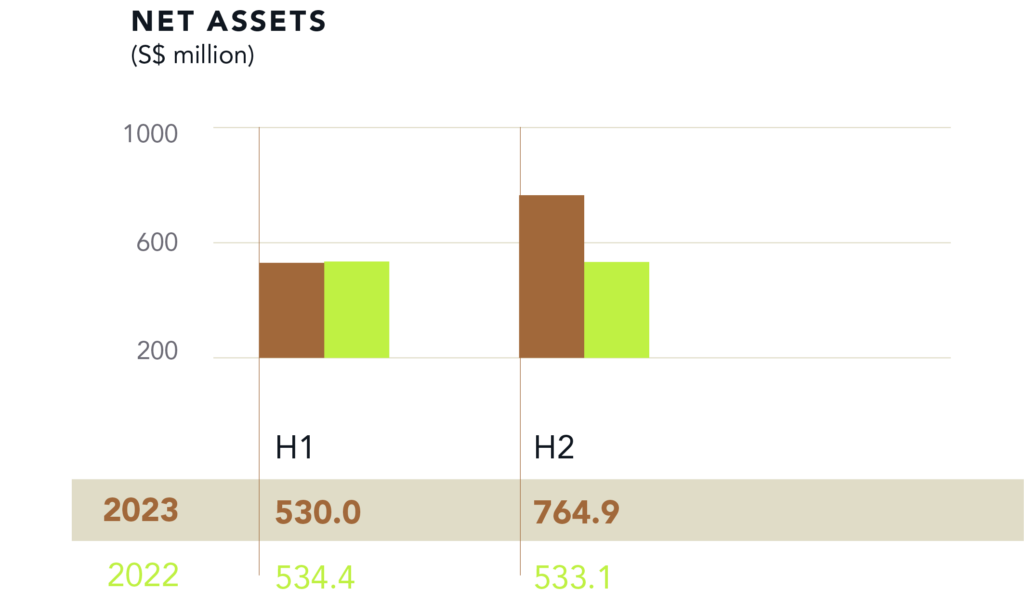

| Net Assets | 747.4 | 627.6 | 538.1 | 533.1 | 764.9 |

Biannual Highlights

1 Refers to Operating Profit excluding one-off gains or losses. This is an alternative financial measurement and do not have a standardised meaning prescribed by Singapore Financial Reporting Standards (International).

2 Refers to Earnings before interests, taxes, depreciation and amortisation (“EBITDA”).

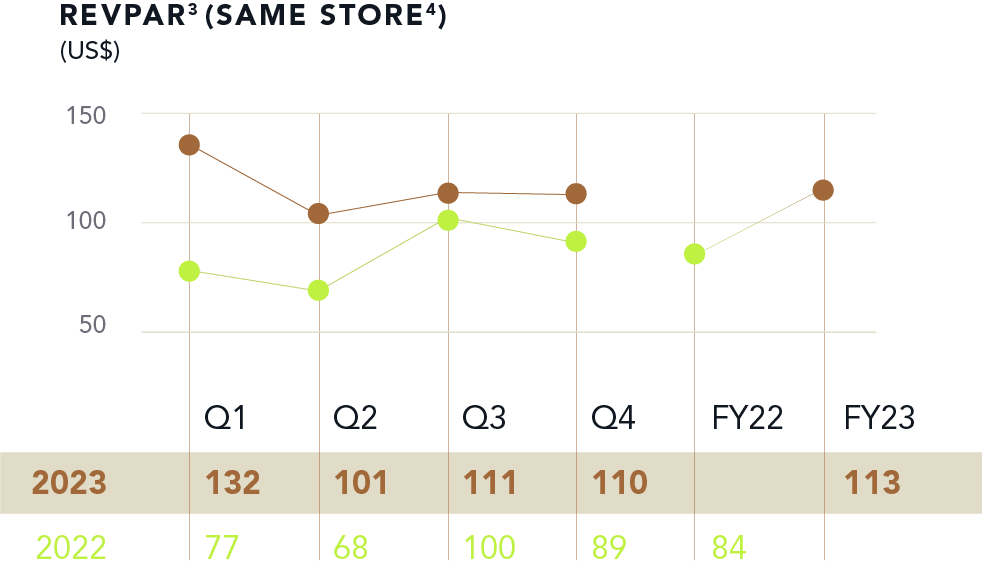

3 RevPAR denotes revenue per available room.

4 Same Store concept includes resorts/hotels which are in operations in both current and comparative periods.

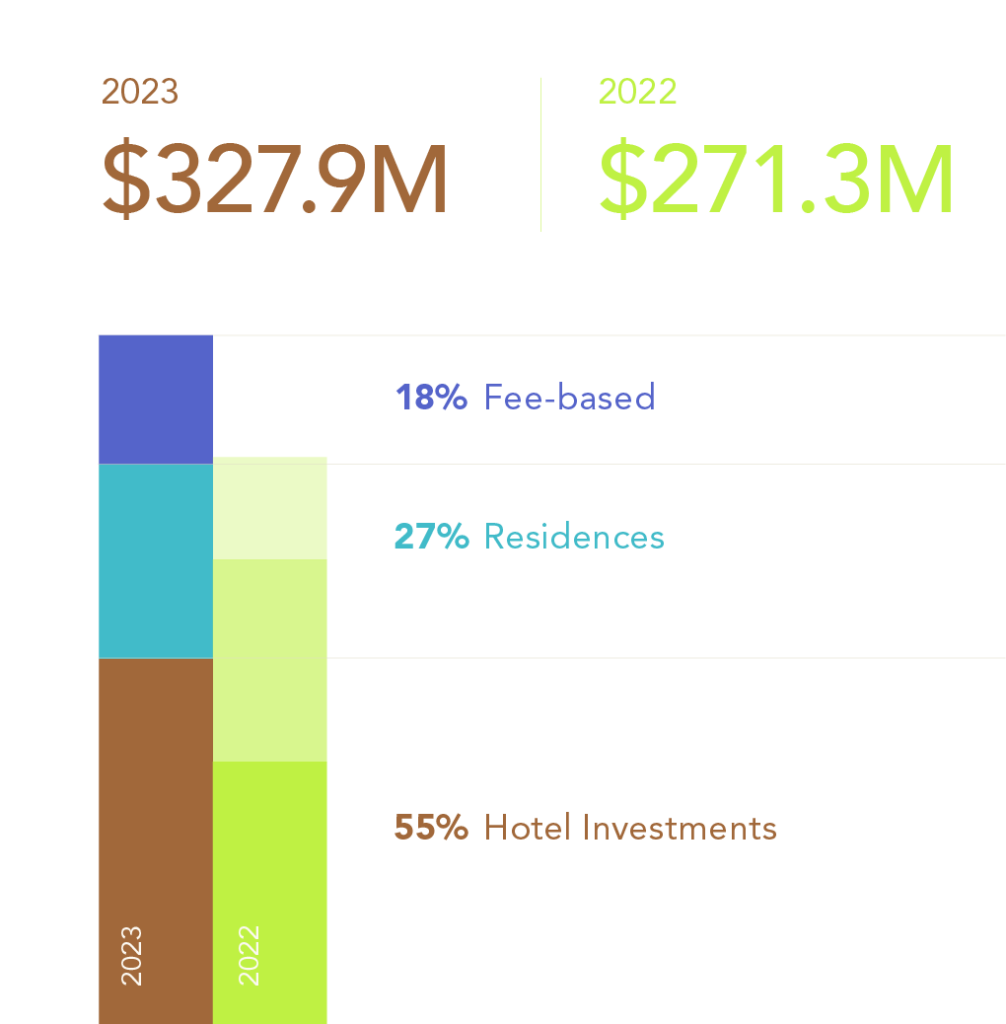

Group Revenue

Banyan Tree Holdings Limited and its subsidiaries (“Banyan Group” or “the Group”) is an independent, global hospitality company with purpose. Founded in 1994 , we have grown our footprint to 22 countries across the world. We operate with multi-branded presence in 10 of these, capitalising on their potential as high-growth travel destinations.

With over 10,000 associates, we create distinctive, design-led experiences while pursuing the Group’s mission to create long-term benefits for all our stakeholders. As a pioneer of sustainable hospitality, we remain committed to “Embracing the Environment, Empowering People” through our business.

Revenue Figures

| 2023 S$'m | 2023 % | 2022 S$'m | 2022 % |

|

| Group | 327.9 | 100% | 271.3 | 100% |

| Hotel Investments | 180.7 | 55% | 134.5 | 50% |

| Residences | 87.3 | 27% | 90.8 | 33% |

| Fee-based | 59.9 | 18% | 46.0 | 17% |

| Hotel Investments | 180.7 | 100% | 134.5 | 100% |

| Thailand | 127.9 | 71% | 84.9 | 63% |

| Indian Oceania | 43.5 | 24% | 45.2 | 34% |

| Others | 9.3 | 5% | 4.4 | 3% |

| Residences | 87.3 | 100% | 90.8 | 100% |

| Fee-based | 59.9 | 100% | 46.0 | 100% |

| Hotel Management | 37.0 | 62% | 28.4 | 62% |

| Spa, Wellbeing & Gallery | 8.6 | 14% | 6.3 | 14% |

| Design & Other Services | 14.3 | 24% | 11.3 | 24% |

Resilience from Diversification

Diversification has been vital to the Group’s resilience. Our portfolio of offerings encompasses hotels, residences, F&B, wellbeing, retail and membership. At the same time, our multi-brand portfolio has yielded a diverse and thus resilient market mix. Our intentional strategy of diversifying the market mix of hotel guests has likewise borne fruit.

Compared to 2019, we have expanded our key markets beyond the UK, US and China, driven largely by an increase in domestic and regional tourism especially in Asia and a diversification of our brand offerings and operating footprint.

2023 was a comeback year for Banyan Group. With the strong rebound in tourism, Group revenue was 21% higher year-on-year and Core Operating Profit more than doubled to S$51.9 million. Hotel Revenue Per Available Room (RevPAR) increased by 35% (on a samestore basis) compared to 2022, while the Residences segment posted an all-time high of S$267.8 million worth of new sales. Importantly, China lifted travel restrictions in early 2023, leading to more than fivefold increase in outbound sales revenue. The above results indicate a resilient post-pandemic recovery for the Group, setting the stage for robust growth in 2024.

Strengthening Sales & Marketing

Further expansion of our direct channels increased their contribution by 27% in 2023 as compared with the previous year.

Global campaigns and promotions played an important role in bolstering our hotel business. We ran two global campaigns. “Live Well, Travel Well” aims to inspire guests to experience life through a different lens, while “Summer Stories” invites them to create their dream vacations in breath-taking destinations like Mexico and Japan. In 2023, revenue from these campaigns grew by a strong 117% against 2022.

At a more granular level, we drove incremental revenue by targeting new audiences and focusing marketing efforts on differentiated segments, such as families, couples and individuals pursuing wellbeing.

Transformation of the Group’s Sales & Marketing continued as we harnessed digital technology more effectively. The introduction of automated marketing in customer relationship management led to a more than twofold increase in total attributed revenue.

Elevating Guest Satisfaction

Our constant efforts to create exceptional experiences succeeded in raising our global scoring on guest satisfaction in 2023. The Guest Review Index (GRI), which measures online reviews from over 175 Online Travel Agents (OTAs) including Expedia and Tripadvisor, improved from 94.0% to 94.5%, while our Net Promoter Score (NPS) improved by nearly 10 points year-on-year.

We also continue to outperform the market, as shown by our score of 101.5% on the Competitive Quality Index (CQI) in 2023, an improvement of 0.2 points over 2022.

Hotel Investments

We own and manage hotels under Banyan Group’s portfolio of brands.

As of 31 December 2023, we owned 12 hotels, comprising over 1,700 keys.

Residences

This segment encompasses the sales of branded Residences, including some that operate under a leaseback scheme.

Under the leaseback arrangement, villas or apartments are sold to investors who then lease them back as part of our hotel operations. These residences are presently offered in China, Indonesia, Mexico, Thailand and Vietnam.

Additionally, this segment includes other residential properties such as townhomes, bungalows and apartments situated within the vicinity of our resorts but not integrated into our hotel operations. These residences, notably Banyan Tree, Angsana, Skypark and Laguna, are currently available for sale in Thailand and Vietnam.

Fee-based

Our Fee-based business comprises hotel management, spa, wellbeing & gallery, and design & other services. We manage 63 resorts and hotels (include fully managed, franchise and co-development properties) and operate 62 spas, 59 gallery outlets and three golf courses.

Hotel Management

Besides managing hotels for other owners, we manage an asset-backed destination club and a private equity fund. In addition, the Group derives royalties from the sale of properties in which we hold a minority or no interest.

Spa, Wellbeing & Gallery

We pioneered the tropical garden spa concept and manage spas within our own resorts as well as resorts owned by other operators. The Group’s retail arm Gallery, supports indigenous artistry and the livelihoods of village artisans.

Design & Other Services

We receive fees for design services and income from operating golf clubs. Most of our resorts are planned and designed by our experienced in-house division.